How to Build a Strong PPP Fraud Defense Strategy

By : saulcrim | Category : Criminal Defense | Comments Off on How to Build a Strong PPP Fraud Defense Strategy

5th May 2025

Facing allegations of PPP fraud can be overwhelming and potentially devastating for business owners. At Law Offices of Scott B. Saul, we understand the complexities of these cases and the importance of a strong PPP fraud defense strategy.

This blog post will guide you through the key elements of building a robust defense against PPP fraud charges. We’ll explore common allegations, essential defense tactics, and the critical role of experienced legal representation in protecting your rights and future.

What Are PPP Fraud Allegations?

PPP fraud allegations represent serious accusations that can significantly impact business owners. The U.S. Department of Justice (DOJ) actively pursues cases of alleged fraud related to the Paycheck Protection Program (PPP), which was established to provide financial support to businesses during the COVID-19 pandemic.

Types of PPP Fraud Charges

PPP fraud charges typically fall into several categories:

- False Information Submission: This includes inflating payroll expenses, misrepresenting employee numbers, or providing inaccurate financial statements on loan applications.

- Misuse of Funds: Using PPP funds for unauthorized purposes (e.g., personal expenses or unrelated investments).

- Identity Theft: Applying for PPP loans using stolen or fabricated business information.

- Multiple Loan Applications: Submitting applications for multiple PPP loans when only one was permitted.

Burden of Proof for Prosecutors

To secure a conviction in a PPP fraud case, prosecutors must prove several key elements beyond a reasonable doubt:

- Intentional Misrepresentation: They must demonstrate that the defendant knowingly made false statements or misrepresentations in their PPP loan application or fund usage. This involves proving that the actions were intentional, not mere mistakes or misunderstandings of the program’s complex rules.

- Material Impact: Prosecutors must establish that the false statements significantly influenced the decision to grant or forgive the PPP loan.

Potential Penalties for PPP Fraud

The consequences of PPP fraud convictions can be severe:

- Legal Penalties: Individuals found guilty can face substantial fines (up to $1 million) and imprisonment (up to 30 years in federal prison), depending on the fraud’s severity and scale.

- Financial Repercussions: Courts may order restitution, requiring the repayment of fraudulently obtained funds. The government might also pursue asset forfeiture, seizing property and assets acquired with illegally obtained PPP money.

- Professional and Personal Impact: A PPP fraud conviction can result in the loss of professional licenses, reputational damage, and difficulties in securing future employment or loans.

The complexity of PPP fraud cases underscores the importance of experienced legal representation. Attorneys with a background in federal prosecutions (like those at the Law Offices of Scott B. Saul) possess unique insights that can prove invaluable in building strong defense strategies. As we move forward, we’ll explore the critical steps in constructing a robust defense against these serious allegations.

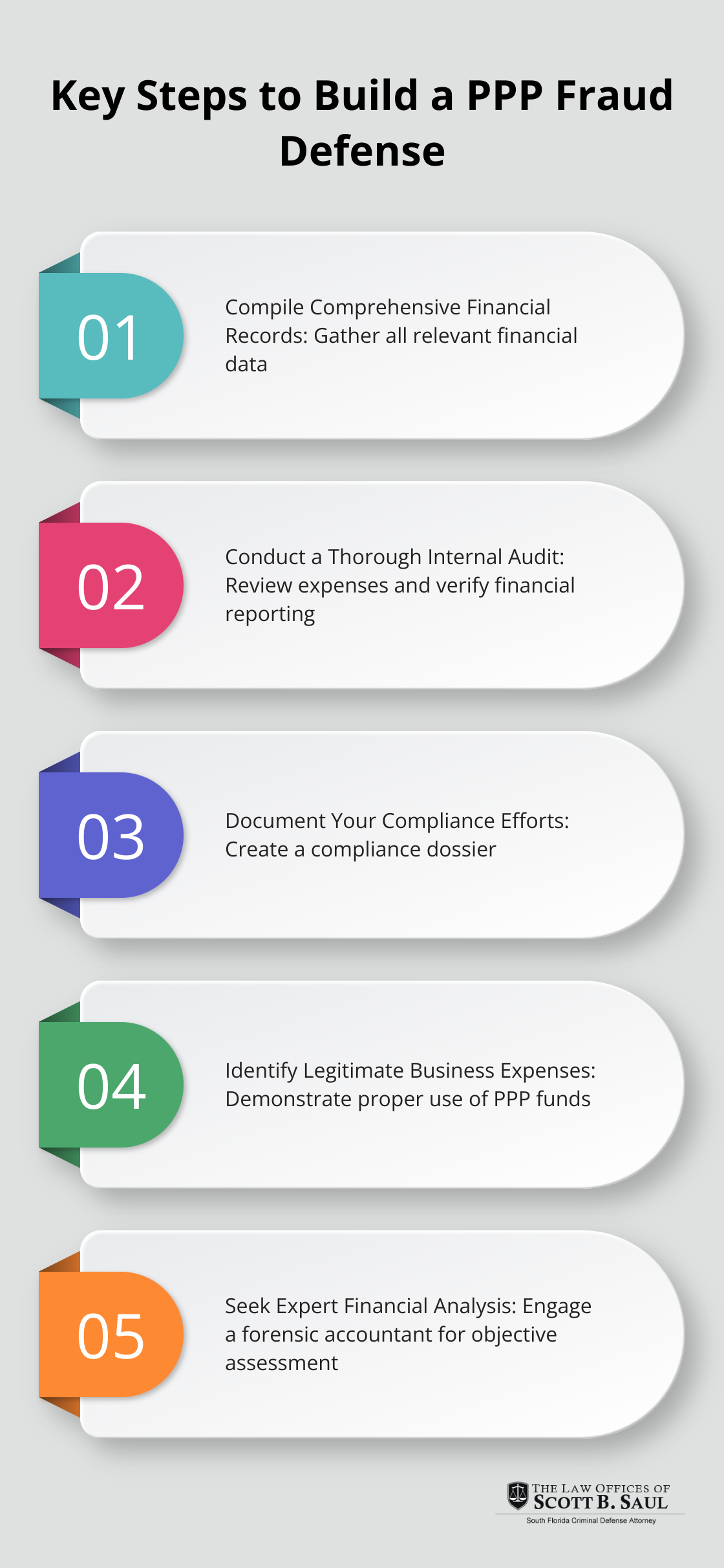

How to Build an Ironclad PPP Fraud Defense

Compile Comprehensive Financial Records

The foundation of your defense rests on your financial documentation. Collect every piece of financial data related to your PPP loan application and fund usage. This includes:

- Bank statements

- Payroll records

- Tax returns

- Expense receipts

- Loan application documents

Organize these records chronologically and create a detailed timeline of your PPP loan process. This level of organization not only aids your defense but also demonstrates your commitment to transparency.

The Paycheck Protection Program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. Funds can also be used to pay interest on mortgages and other specified expenses.

Conduct a Thorough Internal Audit

Before the prosecution examines your finances, perform your own internal audit. This proactive approach can uncover potential issues and allow you to address them head-on. During your audit:

- Review all expenses paid with PPP funds

- Verify that employee counts and payroll amounts match your loan application

- Check for any discrepancies in financial reporting

If you find errors, document them and prepare explanations. Honest mistakes occur, especially given the complex and rapidly changing PPP guidelines. The key is to identify and address these issues before they’re used against you.

It’s important to note that implementing an antifraud strategy for Unemployment Insurance (UI) based on a fraud risk profile consistent with leading practices is recommended.

Document Your Compliance Efforts

Your defense should highlight every effort you made to comply with PPP rules. Create a compliance dossier that includes:

- Copies of PPP guidance you relied on when applying for and using the loan

- Notes from conversations with lenders or SBA representatives

- Internal memos or emails discussing PPP compliance

- Records of any training or informational sessions your team attended regarding PPP

This documentation serves as evidence of your good faith efforts to follow the rules, which can be vital in defending against fraud allegations.

Identify Legitimate Business Expenses

A key part of your defense will demonstrate that PPP funds were used for legitimate business purposes. Create a detailed breakdown of how the funds were spent, categorizing expenses according to PPP guidelines. Focus on:

- Payroll costs

- Rent or mortgage interest payments

- Utilities

- Other allowed expenses under PPP rules

For each expense, provide supporting documentation and a clear explanation of how it relates to maintaining your business operations during the pandemic.

Seek Expert Financial Analysis

Consider engaging a forensic accountant to review your financial records. Their expert analysis can:

- Identify any potential red flags in your financial data

- Provide an objective assessment of your PPP fund usage

- Offer expert testimony if your case goes to trial

This third-party validation of your financial practices can significantly strengthen your defense.

As you build your defense strategy, it’s essential to work with experienced legal counsel. The next section will explore the benefits of partnering with a skilled PPP fraud defense attorney and how they can help protect your rights throughout the legal process.

Why Expert Legal Counsel Is Essential in PPP Fraud Cases

Specialized Knowledge and Experience

Attorneys with experience in federal prosecutions bring invaluable insights to PPP fraud defense strategies. These legal experts understand the intricacies of PPP regulations and can anticipate prosecution tactics. Their specialized knowledge allows them to navigate the complex landscape of federal fraud cases effectively.

Meticulous Evidence Analysis

Skilled defense attorneys examine all evidence related to a case with extreme attention to detail. They scrutinize financial records, loan applications, and fund usage documentation. This detailed analysis often uncovers inconsistencies or errors in the prosecution’s case.

For example, a defense attorney might identify discrepancies between reported payroll expenses and actual bank records. Such findings can significantly weaken the prosecution’s arguments. In a recent case (not related to our firm), a thorough review of financial documents revealed that the client had actually underclaimed eligible expenses, which countered allegations of inflated numbers.

Strategic Evidence Challenges

Experienced attorneys know how to challenge evidence effectively. They file motions to suppress improperly obtained evidence or question the reliability of prosecution witnesses. They might argue that certain financial records were obtained without proper authorization, potentially leading to their exclusion from trial.

Defense lawyers also work with forensic accountants to provide expert testimony. These specialists explain complex financial transactions and demonstrate compliance with PPP guidelines. Their testimony often proves critical in creating reasonable doubt about fraud allegations.

Negotiation Expertise

Skilled defense attorneys excel in negotiations with prosecutors. They use their understanding of federal sentencing guidelines and case precedents to advocate for reduced charges or even case dismissals.

In a recent PPP fraud case (not involving our firm), negotiations led to a significant reduction in charges. The original indictment included multiple felony counts, but the final plea agreement resulted in a single misdemeanor charge. This outcome dramatically reduced the potential penalties and long-term consequences for the client.

Comprehensive Defense Strategy

Expert legal counsel develops a comprehensive defense strategy tailored to each client’s unique situation. This strategy may include:

- Conducting internal audits to identify potential issues

- Preparing clients for depositions and court appearances

- Engaging expert witnesses to support the defense

- Developing alternative narratives to explain financial discrepancies

The Law Offices of Scott B. Saul combines extensive trial experience with deep knowledge of PPP regulations. Our approach focuses on building the strongest possible defense while exploring all options for favorable resolutions.

Final Thoughts

A strong PPP fraud defense strategy requires a multifaceted approach. Meticulous financial documentation and demonstration of good faith compliance efforts protect your rights and future. The complexity of PPP regulations and severe consequences of fraud allegations highlight the need for swift action when facing charges.

Time plays a critical role in PPP fraud cases. Early intervention allows for thorough evidence review, potential issue identification, and robust defense strategy development. Prompt action demonstrates proactivity and commitment to resolution, which can positively influence case outcomes.

Law Offices of Scott B. Saul brings extensive criminal defense experience to PPP fraud cases. Our team’s background in federal prosecutions provides unique insights into effective defense strategies. We offer personalized attention, comprehensive case analysis, and aggressive representation to protect our clients’ rights throughout the legal process (including negotiations and trial defense).

Archives

- September 2025 (1)

- August 2025 (8)

- July 2025 (8)

- June 2025 (9)

- May 2025 (9)

- April 2025 (8)

- March 2025 (9)

- February 2025 (8)

- January 2025 (9)

- December 2024 (10)

- November 2024 (5)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (2)

- November 2023 (2)

- October 2023 (2)

- September 2023 (2)

- August 2023 (1)

- July 2023 (2)

- June 2023 (2)

- May 2023 (2)

- April 2023 (2)

- March 2023 (2)

- February 2023 (2)

- January 2023 (2)

- December 2022 (2)

- November 2022 (2)

- October 2022 (2)

- September 2022 (2)

- August 2022 (2)

- July 2022 (2)

- June 2022 (2)

- May 2022 (2)

- April 2022 (2)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- December 2021 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (2)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- April 2021 (2)

- September 2020 (5)

- July 2020 (4)

- June 2020 (4)

- May 2020 (4)

- April 2020 (5)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (1)

- November 2019 (4)

- October 2019 (4)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (4)

- April 2019 (4)

- March 2019 (4)

- February 2019 (4)

- January 2019 (4)

- December 2018 (4)

- November 2018 (5)

- October 2018 (5)

- September 2018 (4)

- August 2018 (4)

- July 2018 (7)

- June 2018 (4)

- May 2018 (4)

- April 2018 (8)

- March 2018 (4)

- February 2018 (4)

- January 2018 (4)

- November 2017 (4)

- October 2017 (4)

- September 2017 (4)

- August 2017 (7)

- July 2017 (6)

- June 2017 (4)

- May 2017 (4)

- April 2017 (4)

- March 2017 (4)

- February 2017 (7)

- January 2017 (4)

- December 2016 (7)

- November 2016 (4)

- October 2016 (4)

- September 2016 (10)

- August 2016 (4)

- July 2016 (4)

- June 2016 (4)

- May 2016 (4)

- April 2016 (4)

- March 2016 (4)

- February 2016 (7)

- January 2016 (4)

- December 2015 (5)

- November 2015 (4)

- October 2015 (7)

- September 2015 (4)

- August 2015 (4)

- July 2015 (13)

- June 2015 (9)

- May 2015 (8)

- April 2015 (6)

- March 2015 (4)

- February 2015 (4)

- January 2015 (4)

- December 2014 (4)

- November 2014 (4)

- October 2014 (4)

- September 2014 (3)

Categories

- Adjudication (1)

- Bankruptcy (1)

- Burglary Crimes (3)

- calendar call (1)

- Car Accident (1)

- Criminal Defense (348)

- Cyber Crimes (7)

- DNA (1)

- Domestic Violence (9)

- Drug Crimes (5)

- DUI (12)

- Embezzlement (1)

- Environmental Crimes (4)

- Expungement Law (2)

- Federal Sentencing Law (3)

- Firearm (3)

- Forgery (4)

- General (82)

- Healthcare (3)

- Immigration (1)

- Indentity Theft (1)

- Insurance (5)

- judicial sounding (2)

- Juvenile Crimes (4)

- Manslaughter (4)

- Money Laundering (3)

- Organized Crime (1)

- Racketeering (1)

- Reckless Driving (3)

- RICO (3)

- Sealing and Expunging (2)

- Sex Offense (1)

- Shoplifting (1)

- Suspended Driver's License (1)

- Traffic (4)

- Trending Topics (1)

- White-collar Offenses (1)