How to Avoid Income Tax Fraud Punishment

By : saulcrim | Category : Criminal Defense | Comments Off on How to Avoid Income Tax Fraud Punishment

2nd Feb 2026

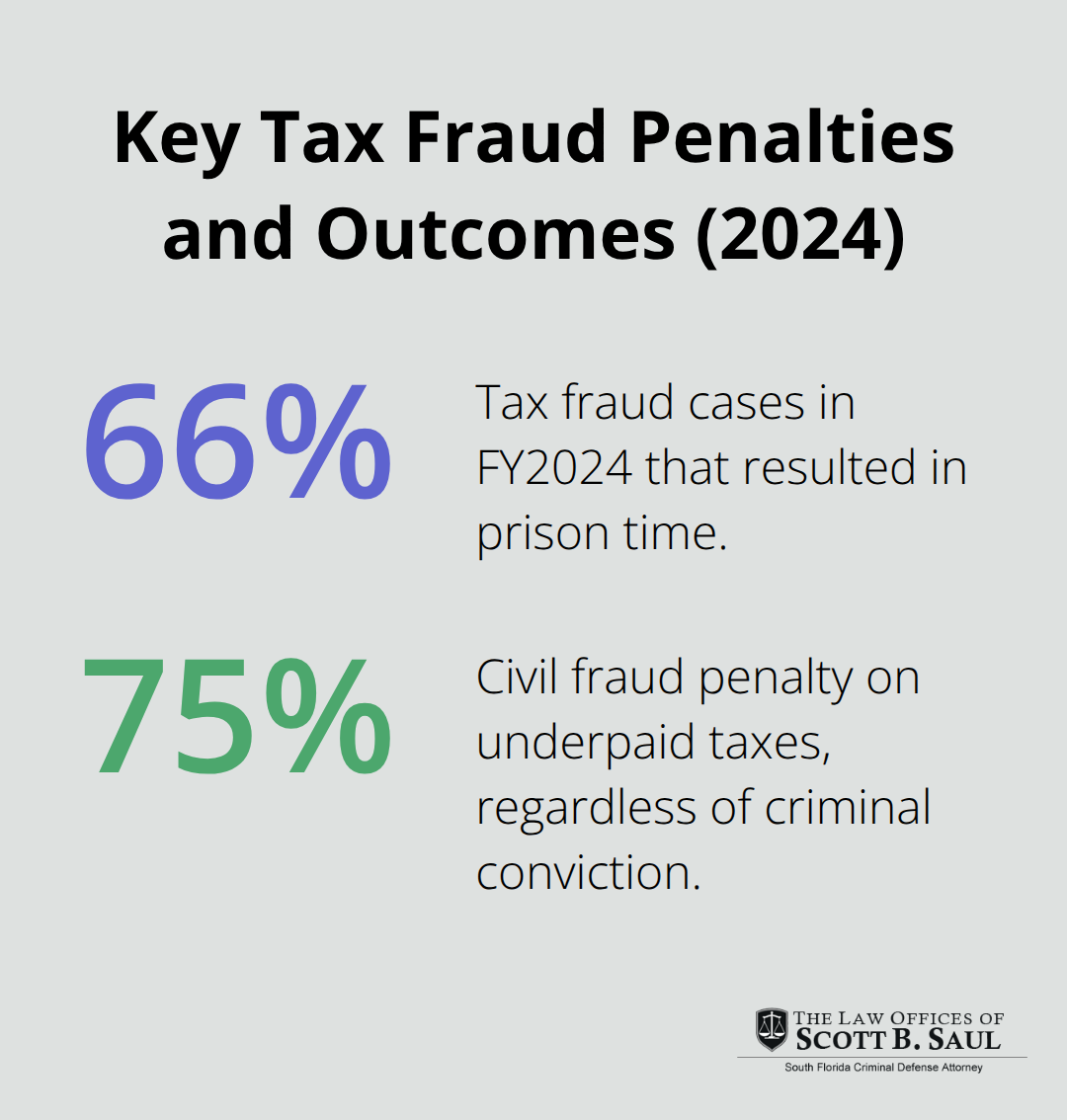

The IRS takes tax violations seriously, and the penalties for income tax fraud can be severe. Fines reaching 75% of unpaid taxes, criminal prosecution, and even prison time are real consequences that many people face.

At Law Offices of Scott B. Saul, we’ve seen how quickly a tax mistake can spiral into a serious legal problem. The good news is that understanding what constitutes fraud and taking deliberate steps to avoid it can protect you from devastating penalties.

What Counts as Income Tax Fraud

Income tax fraud is not a gray area-it’s the willful concealment of income or false claims made with the intent to reduce your tax liability. The IRS distinguishes this from tax avoidance, which uses legal strategies to minimize what you owe. The difference matters enormously because fraud carries criminal penalties including up to five years in prison, while avoidance is perfectly legal. According to the United States Sentencing Commission, 360 tax fraud cases were prosecuted in fiscal year 2024, with an average sentence of 15 months and 66% resulting in prison time. The median loss per offense was $491,302, showing that the IRS pursues cases across income levels. What separates fraud from a simple mistake is intent-you must knowingly and deliberately misrepresent facts to trigger criminal liability.

Civil fraud, however, carries a 75% penalty on underpaid taxes regardless of criminal conviction, making accuracy non-negotiable even if criminal charges never materialize.

Hiding Income from Multiple Sources

Underreporting income stands as the most common trigger for fraud investigations. This includes wages, freelance earnings, rental income, investment gains, and cash payments. Many people assume the IRS won’t catch unreported income if it’s small or comes from informal arrangements, but this assumption is dangerously wrong. The IRS uses Bank Secrecy Act data, third-party reporting (W-2s, 1099s, K-1s), and cross-matching algorithms to identify discrepancies. If you receive $600 or more in payments from platforms like PayPal or Venmo, those transactions are reported to the IRS. Offshore accounts and FBAR filing requirements face strict scrutiny. The IRS Criminal Investigation division recovered billions in fraud using these financial tracking tools, with high conviction rates proving their effectiveness. If you work multiple jobs or have side income, report every dollar on your return. Omitting even one source creates a paper trail that auditors follow relentlessly.

Falsifying Documents and Deductions

Inflated or fabricated deductions rank second among fraud indicators. This includes claiming business expenses you didn’t incur, inflating charitable donations, or creating fake home office deductions. The IRS flags returns with deduction-to-income ratios that deviate significantly from industry norms-a freelancer claiming 80% of gross income as home office expenses will draw scrutiny instantly. Falsifying supporting documents amplifies the problem. Altered receipts, fake invoices, or personal expenses claimed as business costs are all prosecutable offenses. In FY2024, 16.9% of tax fraud cases involved sophisticated means, according to the Sentencing Commission, meaning the IRS recognizes and punishes elaborate schemes. If you claim a $15,000 charitable deduction, the IRS may request substantiation from the charity itself. Dishonest tax preparers often encourage inflated claims to justify high fees or promise unrealistic refunds-avoid these professionals entirely. The safest approach involves claiming only deductions you can document completely and that genuinely apply to your situation.

Concealing Assets and Unreported Accounts

Hiding assets or failing to disclose foreign accounts crosses into serious territory. U.S. citizens and residents must report foreign financial accounts exceeding $10,000 using FBAR filings, and failure to do so carries civil penalties starting at $10,000 per unreported account per year. Criminal penalties can reach $250,000 or more plus prison time. Trusts, shell corporations, and offshore arrangements designed specifically to hide income from taxation face aggressive prosecution. The IRS has enforcement agreements with numerous countries and access to international banking data, making concealment increasingly difficult. If you hold cryptocurrency, foreign investment accounts, or real estate abroad, disclosure is mandatory. Many people believe these accounts are private, but that belief has destroyed countless cases and resulted in federal prosecution. Transparency with a qualified tax professional before filing protects you far more than secrecy ever will.

The Intent Factor Separates Fraud from Mistakes

The line between an honest error and criminal fraud hinges on intent. A miscalculation on your Schedule C or a missed deduction typically triggers an audit and correction, not prosecution. Intentional misrepresentation-deliberately omitting income you knew you received, falsifying documents, or hiding assets-crosses into fraud territory. The IRS examines whether you acted with knowledge and willfulness. Sloppy recordkeeping or poor tax knowledge alone won’t result in criminal charges, but deliberate concealment will. This distinction explains why working with a qualified tax professional matters so much; they help you report accurately and document your positions defensibly. When the IRS investigates, agents look for badges of fraud: missing records, inconsistent statements, unusual cash deposits, and lifestyle expenses that exceed reported income. Understanding these markers helps you avoid the behaviors that trigger criminal prosecution.

Understanding what constitutes fraud positions you to make better decisions about your tax filings. The next section examines the specific mistakes that lead to fraud charges-and how to avoid them.

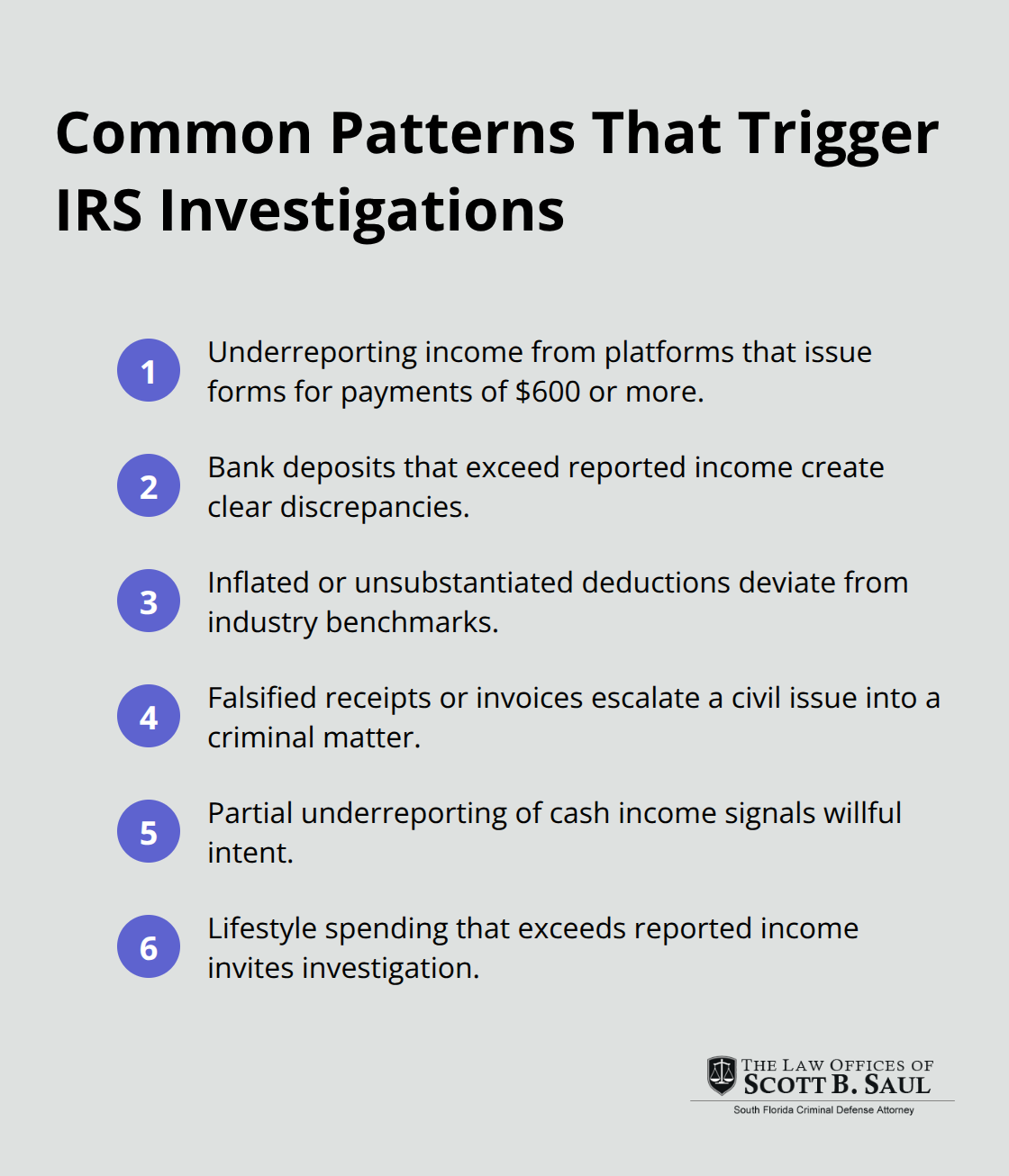

Mistakes That Trigger IRS Investigations

The gap between a filing error and prosecutable fraud narrows faster than most people realize. In fiscal year 2024, the United States Sentencing Commission reported 360 tax fraud convictions with a median loss of $491,302 per case, meaning the IRS pursues violations across all income brackets. The cases that land people in federal prison share common patterns.

Underreporting Income from Multiple Sources

Underreporting income from side gigs, rental properties, or freelance work tops the list because it creates a documented discrepancy the IRS can trace through third-party reporting. If you receive $600 or more from Venmo, PayPal, or any payment platform, that transaction flows directly to the IRS. Construction workers paid in cash, consultants with informal clients, and rental property owners who pocket deposits without reporting them all assume their income flies under the radar-it does not.

The IRS Criminal Investigation division uses Bank Secrecy Act data to cross-reference bank deposits against reported income. A construction worker depositing $50,000 annually while reporting $20,000 in income creates an obvious red flag. The IRS examines bank deposits, credit card processing statements, and inventory records to estimate actual revenue.

A restaurant reporting $300,000 in annual income while processing $800,000 in credit card transactions and maintaining inventory levels consistent with higher sales invites criminal investigation.

Inflating Deductions and Falsifying Documents

Claiming inflated deductions compounds the problem significantly. Home office deductions that consume 70 percent of your gross income, vehicle expenses that exceed actual mileage records, or charitable donations without substantiation invite scrutiny. The IRS maintains industry benchmarks for deduction-to-income ratios and flags returns that deviate dramatically. A consultant claiming $100,000 in home office expenses on $120,000 of revenue will be audited.

Adding falsified receipts or backdated invoices transforms a questionable deduction into a criminal matter. Sophisticated means were used to conceal the fraud in tax fraud cases, indicating the IRS recognizes elaborate schemes and punishes them harshly. Dishonest tax preparers often encourage inflated claims to justify high fees or promise unrealistic refunds-avoid these professionals entirely.

Cash Transactions and Lifestyle Mismatches

Cash transactions present their own hazard. Restaurants, retail shops, and service businesses that receive substantial cash payments face intense scrutiny if reported income does not align with business volume. Even partial underreporting of cash income-saying you kept 10 percent off the books-creates willful intent to defraud once documented.

The IRS also examines lifestyle expenses against reported income. A taxpayer reporting $50,000 annually while purchasing luxury vehicles, maintaining multiple properties, and taking frequent international trips triggers investigation. These lifestyle-to-income mismatches signal that unreported income exists somewhere in the financial picture.

Intent Separates Fraud from Honest Mistakes

The IRS distinguishes between honest mistakes and deliberate concealment. A missed 1099 form or miscalculated deduction typically results in a correction notice and interest owed. Deliberately omitting known income or fabricating documents crosses into criminal territory. This distinction matters enormously because tax fraud convictions can result in prison time, with sentences varying based on case severity.

The IRS examines whether you acted with knowledge and willfulness. Sloppy recordkeeping or poor tax knowledge alone will not result in criminal charges, but deliberate concealment will. When agents investigate, they look for badges of fraud: missing records, inconsistent statements, unusual cash deposits, and lifestyle expenses that exceed reported income. Understanding these markers helps you avoid the behaviors that trigger criminal prosecution.

The safest path forward involves reporting all income sources completely and claiming only deductions you can document fully. These preventive steps matter far more than attempting to explain discrepancies after an audit begins. The next section examines how to protect yourself from fraud allegations before the IRS ever knocks on your door.

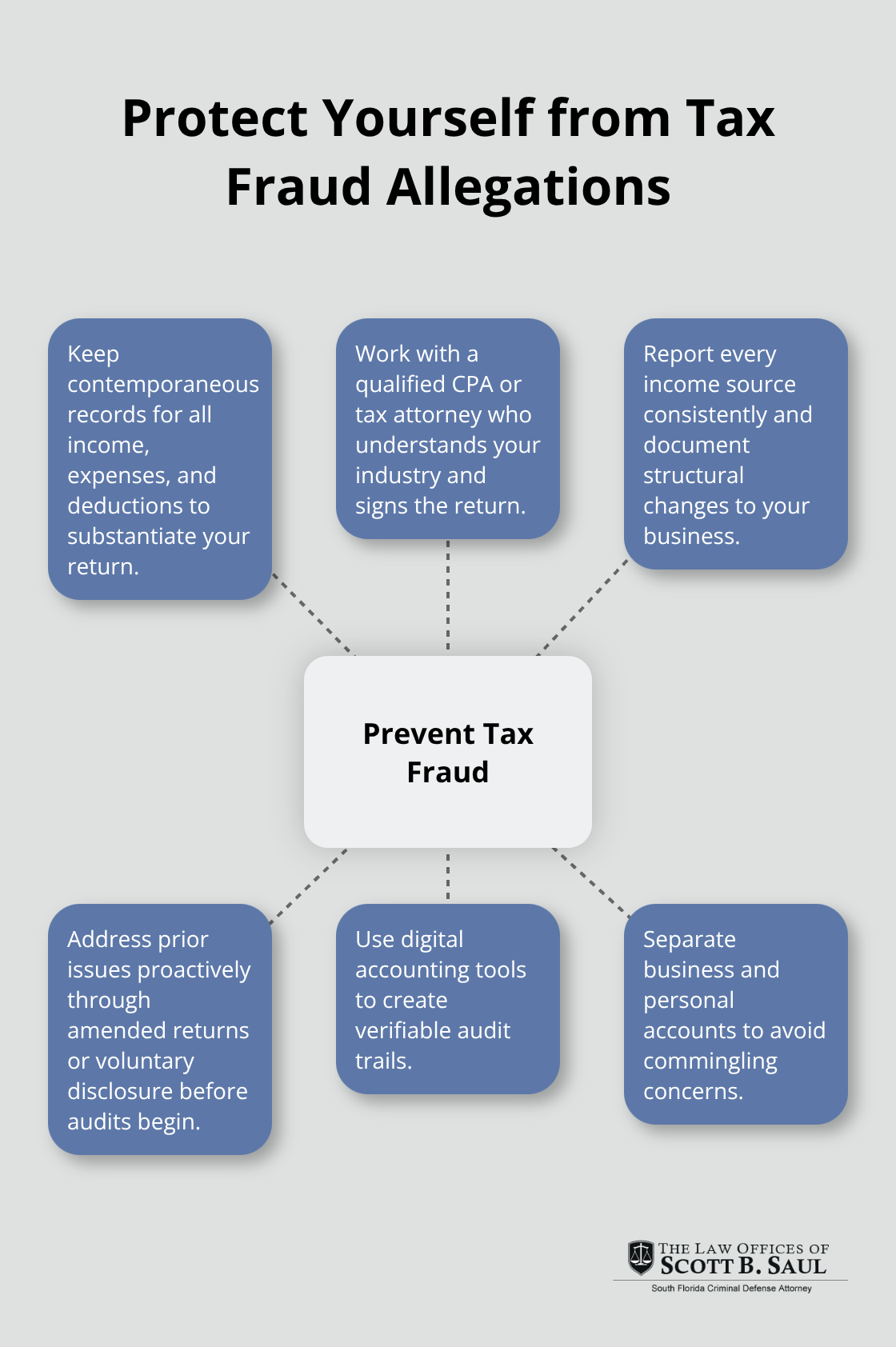

How to Protect Yourself from Tax Fraud Allegations

Documentation forms your strongest defense against fraud allegations. Taxpayers who maintain meticulous records from day one rarely face fraud charges, even when audited. The IRS Criminal Investigation division focuses its resources on cases showing willful intent, and intent becomes far harder to prove when your financial records tell a consistent, verifiable story.

Maintain Contemporaneous Records for All Financial Activity

Start by recording all income sources, bank deposits, business expenses, and deductions as they occur. This means receipts, invoices, bank statements, and transaction logs that correspond directly to your tax return entries. If you claim a $5,000 home office deduction, your documentation should show the square footage of your home office, the total square footage of your home, utility bills, and equipment purchases that support that calculation.

Freelancers and business owners should maintain separate bank accounts for business income and expenses. Commingling personal and business funds creates the appearance of chaos that auditors interpret as concealment. The IRS uses sophisticated algorithms to match third-party reports like 1099s and W-2s against your return, so any discrepancies between what you reported and what institutions reported will trigger investigation.

Digital tools like accounting software (QuickBooks, FreshBooks) automatically create audit trails that demonstrate legitimate business operations. These records become your defense if questions arise.

Work with a Qualified Tax Professional

Hiring a qualified tax professional who specializes in your industry costs far less than defending fraud charges. A CPA or tax attorney who understands your business model identifies legitimate deductions you might miss, flags aggressive positions that invite scrutiny, and ensures your return withstands examination.

Avoid preparers who guarantee refunds, charge fees based on refund amounts, or pressure you to claim deductions you’re uncertain about. These red flags indicate someone prioritizing their commission over your legal protection. When you file, your tax preparer should sign the return and take professional responsibility for positions taken. This creates accountability and means they’ve reviewed your documentation before filing.

Report All Income Sources Consistently

Report every income source consistently year to year. Sudden changes in income reporting patterns invite questions about prior years. If your business structure changes, document that transition clearly. A sole proprietor who incorporates should file amended returns if necessary and explain the structural change in writing to the IRS.

The IRS distinguishes between taxpayers who make honest mistakes and those who deliberately conceal facts. Consistent, documented reporting demonstrates good faith. If you’ve previously underreported income or claimed questionable deductions, consult a tax professional immediately about filing amended returns before the IRS contacts you.

Address Past Compliance Issues Proactively

The IRS offers correction mechanisms for taxpayers who voluntarily come into compliance. Initiating this process yourself shows intent to follow the law rather than evade it. Voluntary disclosure before an investigation begins protects you far more effectively than attempting to explain discrepancies after an audit starts. Taxpayers who make timely, truthful voluntary disclosures may avoid criminal prosecution. A tax attorney can guide you through amended filings and penalty mitigation strategies that demonstrate your commitment to accuracy.

Final Thoughts

Income tax fraud punishment ranges from civil penalties reaching 75% of unpaid taxes to criminal sentences averaging 15 months in federal prison. The consequences extend beyond fines and incarceration-they damage your reputation, career prospects, and financial stability for years. Understanding your legal obligations under the Internal Revenue Code removes ambiguity about what the IRS expects from you, since filing requirements are not voluntary and gross income includes compensation from all sources, whether reported on official forms or received informally.

Taking proactive steps now prevents devastating penalties later. Report all income sources consistently, maintain documentation that supports every deduction you claim, and address any past compliance issues before the IRS initiates contact. Voluntary disclosure before an investigation begins demonstrates your commitment to following the law and can shield you from criminal prosecution.

If you face tax allegations or suspect you may be under investigation, contact us immediately. We at Law Offices of Scott B. Saul bring extensive criminal defense experience to tax-related matters, and Scott B. Saul’s background as a former federal and state prosecutor provides unparalleled insight into how the IRS investigates fraud cases. Do not wait until the IRS knocks on your door-reach out to us today for a comprehensive consultation about your situation.

Archives

- February 2026 (1)

- January 2026 (9)

- December 2025 (9)

- November 2025 (8)

- October 2025 (8)

- September 2025 (9)

- August 2025 (8)

- July 2025 (8)

- June 2025 (9)

- May 2025 (9)

- April 2025 (8)

- March 2025 (9)

- February 2025 (8)

- January 2025 (9)

- December 2024 (10)

- November 2024 (5)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (2)

- November 2023 (2)

- October 2023 (2)

- September 2023 (2)

- August 2023 (1)

- July 2023 (2)

- June 2023 (2)

- May 2023 (2)

- April 2023 (2)

- March 2023 (2)

- February 2023 (2)

- January 2023 (2)

- December 2022 (2)

- November 2022 (2)

- October 2022 (2)

- September 2022 (2)

- August 2022 (2)

- July 2022 (2)

- June 2022 (2)

- May 2022 (2)

- April 2022 (2)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- December 2021 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (2)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- April 2021 (2)

- September 2020 (5)

- July 2020 (4)

- June 2020 (4)

- May 2020 (4)

- April 2020 (5)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (1)

- November 2019 (4)

- October 2019 (4)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (4)

- April 2019 (4)

- March 2019 (4)

- February 2019 (4)

- January 2019 (4)

- December 2018 (4)

- November 2018 (5)

- October 2018 (5)

- September 2018 (4)

- August 2018 (4)

- July 2018 (7)

- June 2018 (4)

- May 2018 (4)

- April 2018 (8)

- March 2018 (4)

- February 2018 (4)

- January 2018 (4)

- November 2017 (4)

- October 2017 (4)

- September 2017 (4)

- August 2017 (7)

- July 2017 (6)

- June 2017 (4)

- May 2017 (4)

- April 2017 (4)

- March 2017 (4)

- February 2017 (7)

- January 2017 (4)

- December 2016 (7)

- November 2016 (4)

- October 2016 (4)

- September 2016 (10)

- August 2016 (4)

- July 2016 (4)

- June 2016 (4)

- May 2016 (4)

- April 2016 (4)

- March 2016 (4)

- February 2016 (7)

- January 2016 (4)

- December 2015 (5)

- November 2015 (4)

- October 2015 (7)

- September 2015 (4)

- August 2015 (4)

- July 2015 (13)

- June 2015 (9)

- May 2015 (8)

- April 2015 (6)

- March 2015 (4)

- February 2015 (4)

- January 2015 (4)

- December 2014 (4)

- November 2014 (4)

- October 2014 (4)

- September 2014 (3)

Categories

- Adjudication (1)

- Bankruptcy (1)

- Burglary Crimes (3)

- calendar call (1)

- Car Accident (1)

- Criminal Defense (391)

- Cyber Crimes (7)

- DNA (1)

- Domestic Violence (9)

- Drug Crimes (5)

- DUI (12)

- Embezzlement (1)

- Environmental Crimes (4)

- Expungement Law (2)

- Federal Sentencing Law (3)

- Firearm (3)

- Forgery (4)

- General (82)

- Healthcare (3)

- Immigration (1)

- Indentity Theft (1)

- Insurance (5)

- judicial sounding (2)

- Juvenile Crimes (4)

- Manslaughter (4)

- Money Laundering (3)

- Organized Crime (1)

- Racketeering (1)

- Reckless Driving (3)

- RICO (3)

- Sealing and Expunging (2)

- Sex Offense (1)

- Shoplifting (1)

- Suspended Driver's License (1)

- Traffic (4)

- Trending Topics (1)

- White-collar Offenses (1)