How to Navigate a Tax Fraud Investigation

By : saulcrim | Category : Criminal Defense | Comments Off on How to Navigate a Tax Fraud Investigation

22nd Jan 2026

A tax fraud investigation can feel overwhelming, especially when you’re unsure about your rights or what comes next. The IRS takes these matters seriously, and so should you.

At Law Offices of Scott B. Saul, we’ve guided clients through investigations by helping them understand what’s happening and protecting their interests. This guide walks you through your rights, the steps to take, and how professional legal support makes a real difference.

What the IRS Actually Looks For

Tax fraud isn’t about making an honest mistake on your return. The IRS distinguishes between errors and intentional deception, and this distinction matters enormously. Tax fraud requires willful intent to evade taxes, which means you deliberately underreported income, claimed false deductions, or hid money from the government. According to the Treasury Inspector General for Tax Administration, the IRS criminal investigation division opened approximately 2,000 cases annually in recent years, with conviction rates hovering around 90 percent. This high conviction rate reflects the strength of evidence typically required before criminal charges proceed.

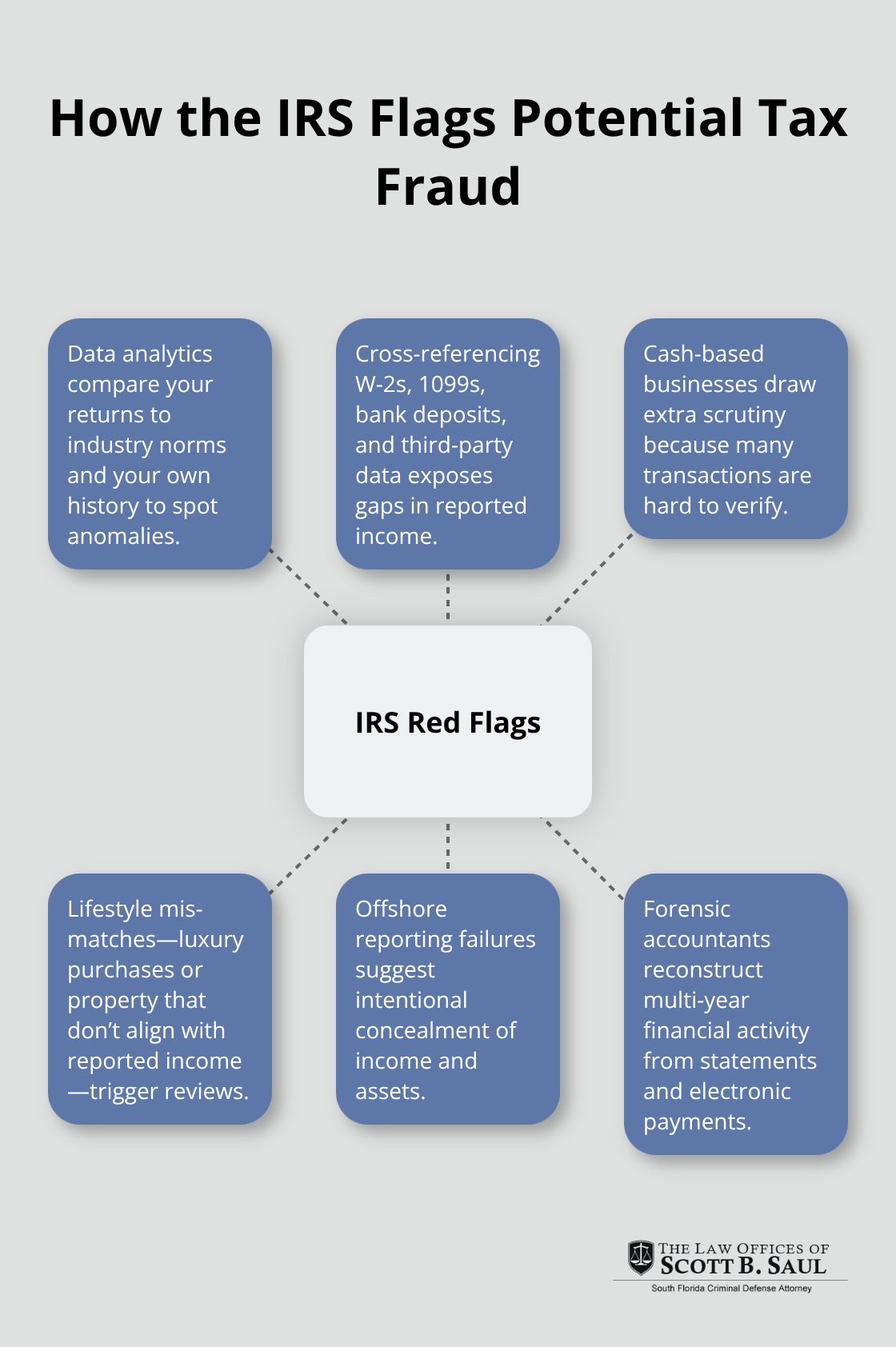

How the IRS Identifies Patterns

The IRS uses data analytics to flag unusual patterns in your returns compared to industry standards and your own history. They cross-reference your reported income against W-2s, 1099s, bank deposits, and third-party information they’ve already collected. A sudden spike in charitable deductions, business expenses drastically below industry norms, or unreported income sources visible in bank records trigger deeper scrutiny. If you own a cash-based business, the IRS pays particular attention because cash transactions are harder to verify. They also examine whether your lifestyle matches your reported income-expensive purchases, luxury vehicles, or property acquisitions that don’t align with your tax filings raise red flags. The IRS Criminal Investigation division uses specialized forensic accountants who reconstruct financial activity from bank statements, credit card records, and electronic payments spanning years.

Offshore Accounts and Reporting Requirements

Offshore accounts without proper reporting remain one of the strongest indicators of intentional fraud in IRS investigations. The Foreign Account Tax Compliance Act requires U.S. citizens to report foreign financial accounts exceeding $10,000, and failure to file these reports signals deliberate evasion to investigators. The IRS treats unreported foreign assets as a primary red flag because hiding money internationally demonstrates clear intent to conceal income.

Suspicious Patterns That Attract Attention

Round-number deductions deserve mention-claiming exactly $5,000 in business expenses every single year looks suspicious compared to naturally varying amounts. Frequent amended returns combined with escalating deductions create a pattern suggesting you’re testing the IRS’s response. Cash deposits followed immediately by cash withdrawals without corresponding business income raise questions about money laundering. Large charitable contributions made shortly before an investigation begins appear as potential desperation moves. The IRS also scrutinizes timing-if your records suddenly become organized only after an audit notice arrives, investigators question whether documentation was fabricated retroactively.

Understanding these patterns helps you recognize why the IRS targets specific cases. Your next step involves knowing what rights protect you when investigators contact you.

What Protections You Actually Have

Your Right to Legal Representation

The moment the IRS contacts you about a potential fraud investigation, your constitutional rights activate whether you acknowledge them or not. You have the right to an attorney, and this isn’t a suggestion-it’s your strongest defense mechanism. Many people make the mistake of trying to cooperate directly with IRS agents, believing honesty will help their case. This approach backfires regularly because anything you say can and will be used against you in criminal proceedings. The IRS Criminal Investigation division operates under the same rules as the FBI, and agents are trained to extract information that builds their case. Once you invoke your right to counsel, agents must stop direct questioning. This isn’t obstruction-it’s the exercise of a fundamental right that protects you during the investigation’s most vulnerable stage.

Your attorney acts as the sole intermediary between you and investigators, controlling what information gets disclosed and when. This buffer prevents you from inadvertently admitting facts that prosecutors could misinterpret or weaponize later.

Protection Against Self-Incrimination

The Fifth Amendment protects you against self-incrimination, meaning you cannot be forced to answer questions that could implicate you in criminal activity. Your legal representative can negotiate with IRS Criminal Investigation to understand the scope of their inquiry, the specific years under review, and whether civil or criminal prosecution is being considered. The IRS distinguishes between civil fraud penalties and criminal prosecution (which can result in up to five years imprisonment and fines exceeding $250,000). Knowing which path investigators are pursuing changes your entire defense strategy.

Accessing Documents and Evidence

You have the right to access and review any documents the IRS uses against you, though your attorney typically handles these requests strategically. Timing matters enormously here-requesting documents too early can signal which areas concern you most, while waiting too long limits your ability to prepare a defense. Your attorney can also file administrative appeals and requests for disclosure that legally compel the government to reveal evidence, preventing you from being blindsided in court.

Why Direct Communication Fails

The worst decision you can make is answering questions without legal representation present, thinking you’ll clarify misunderstandings. IRS agents document everything and use your own words to build their case against you. Your attorney controls the narrative and protects your interests in ways that direct cooperation never can.

Understanding these protections sets the foundation for your next critical decision: what steps you must take immediately after investigators contact you.

Steps to Take If You’re Under Investigation

Secure Your Financial Records Immediately

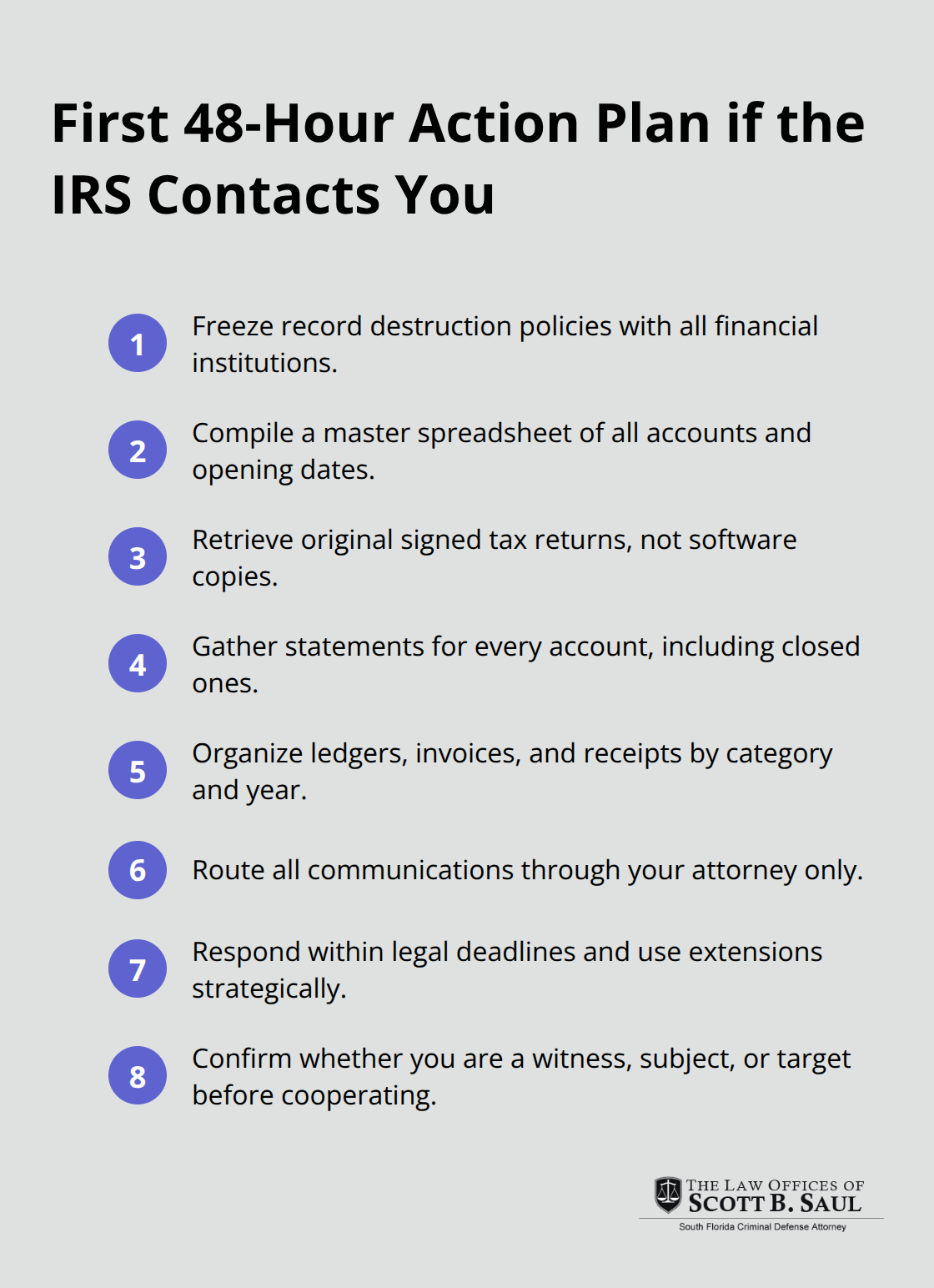

The first 48 hours after an IRS investigation contact determines everything that follows. Your instinct to gather documents and respond quickly is correct, but execution matters far more than speed. Contact your bank, investment firm, and any financial institution holding your accounts to freeze all document destruction policies immediately. Many companies automatically purge records after seven years, and you need everything from the moment the IRS begins questioning you backward through at least five to ten years depending on the investigation’s scope.

Create a master spreadsheet listing every account number, institution, account type, and the dates you opened each one. The IRS Criminal Investigation division cross-references this information against their own records, and discrepancies between what you report and what they’ve already discovered become evidence of intentional concealment. Locate your original tax returns, not copies from your accountant or tax software. Original returns show handwriting, amendments, and filing dates that matter in fraud cases.

Organize Documentation Without Fabrication

If you amended returns, keep both versions clearly labeled with dates. Gather bank statements for every account you’ve ever controlled, even closed accounts, spanning at least the years the IRS specifically mentioned in their inquiry letter. For self-employed individuals or business owners, collect P&L statements, general ledgers, invoices, and expense receipts organized by category and year.

Do not attempt to reconstruct missing records or create documents you cannot locate. Fabricating evidence transforms a potential civil matter into an aggravated criminal case. The IRS Criminal Investigation division examines document metadata to determine when files were created, and backdated or newly created records become smoking-gun evidence against you.

Route All Communication Through Your Attorney

From this moment forward, every communication about your case flows exclusively through your attorney. Do not email the IRS, call agents back, or respond to written requests directly. Your attorney coordinates all responses, timing disclosure strategically based on what’s already known versus what remains hidden.

IRS agents deliberately contact taxpayers on Friday afternoons or right before holidays, hoping to pressure rushed responses without legal counsel present. When you receive a document request, your attorney reviews it carefully to identify fishing expeditions versus legitimate inquiries, then responds with only what’s legally required.

Understand Response Timelines and Negotiation

Responding promptly does not mean responding within hours-it means your attorney files responses within the deadline specified by law, typically 30 days for administrative requests. The IRS Criminal Investigation division operates under strict procedural rules, and your attorney knows exactly how long legitimate delays can extend. Many investigations stall completely when attorneys request reasonable extensions and clarifications about scope.

Your attorney also negotiates whether you’re a subject of the investigation, a target, or a witness. This distinction changes everything about your defense posture. If you’re a witness, cooperation might serve your interests. If you’re a target facing potential criminal charges, cooperation becomes a trap. The IRS won’t tell you directly-your attorney extracts this information through formal inquiries and procedural requests that reveal the government’s actual position.

Final Thoughts

A tax fraud investigation demands immediate action and professional guidance. The decisions you make in the first 48 hours after contact determine whether you protect yourself or inadvertently strengthen the government’s case against you. Attempting to handle this alone, even with good intentions, almost always backfires because IRS Criminal Investigation agents are trained to extract damaging admissions from unprepared taxpayers.

We at Law Offices of Scott B. Saul have seen firsthand how proper legal representation changes outcomes. Your attorney becomes your shield, controlling what information reaches investigators and ensuring every response serves your defense strategy rather than the prosecution’s narrative. The difference between civil penalties and criminal conviction often comes down to whether you had competent counsel from day one (and we bring over 30 years of criminal defense experience to that fight).

Contact an experienced criminal defense attorney before responding to any IRS communication about a tax fraud investigation. Do not wait for a formal indictment or subpoena. Scott B. Saul brings a track record of successfully tried jury cases and a background as a former federal and state prosecutor to protect your rights, which means he understands exactly how the government builds these cases and how to dismantle their strategy.

Archives

- January 2026 (7)

- December 2025 (9)

- November 2025 (8)

- October 2025 (8)

- September 2025 (9)

- August 2025 (8)

- July 2025 (8)

- June 2025 (9)

- May 2025 (9)

- April 2025 (8)

- March 2025 (9)

- February 2025 (8)

- January 2025 (9)

- December 2024 (10)

- November 2024 (5)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (2)

- November 2023 (2)

- October 2023 (2)

- September 2023 (2)

- August 2023 (1)

- July 2023 (2)

- June 2023 (2)

- May 2023 (2)

- April 2023 (2)

- March 2023 (2)

- February 2023 (2)

- January 2023 (2)

- December 2022 (2)

- November 2022 (2)

- October 2022 (2)

- September 2022 (2)

- August 2022 (2)

- July 2022 (2)

- June 2022 (2)

- May 2022 (2)

- April 2022 (2)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- December 2021 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (2)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- April 2021 (2)

- September 2020 (5)

- July 2020 (4)

- June 2020 (4)

- May 2020 (4)

- April 2020 (5)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (1)

- November 2019 (4)

- October 2019 (4)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (4)

- April 2019 (4)

- March 2019 (4)

- February 2019 (4)

- January 2019 (4)

- December 2018 (4)

- November 2018 (5)

- October 2018 (5)

- September 2018 (4)

- August 2018 (4)

- July 2018 (7)

- June 2018 (4)

- May 2018 (4)

- April 2018 (8)

- March 2018 (4)

- February 2018 (4)

- January 2018 (4)

- November 2017 (4)

- October 2017 (4)

- September 2017 (4)

- August 2017 (7)

- July 2017 (6)

- June 2017 (4)

- May 2017 (4)

- April 2017 (4)

- March 2017 (4)

- February 2017 (7)

- January 2017 (4)

- December 2016 (7)

- November 2016 (4)

- October 2016 (4)

- September 2016 (10)

- August 2016 (4)

- July 2016 (4)

- June 2016 (4)

- May 2016 (4)

- April 2016 (4)

- March 2016 (4)

- February 2016 (7)

- January 2016 (4)

- December 2015 (5)

- November 2015 (4)

- October 2015 (7)

- September 2015 (4)

- August 2015 (4)

- July 2015 (13)

- June 2015 (9)

- May 2015 (8)

- April 2015 (6)

- March 2015 (4)

- February 2015 (4)

- January 2015 (4)

- December 2014 (4)

- November 2014 (4)

- October 2014 (4)

- September 2014 (3)

Categories

- Adjudication (1)

- Bankruptcy (1)

- Burglary Crimes (3)

- calendar call (1)

- Car Accident (1)

- Criminal Defense (388)

- Cyber Crimes (7)

- DNA (1)

- Domestic Violence (9)

- Drug Crimes (5)

- DUI (12)

- Embezzlement (1)

- Environmental Crimes (4)

- Expungement Law (2)

- Federal Sentencing Law (3)

- Firearm (3)

- Forgery (4)

- General (82)

- Healthcare (3)

- Immigration (1)

- Indentity Theft (1)

- Insurance (5)

- judicial sounding (2)

- Juvenile Crimes (4)

- Manslaughter (4)

- Money Laundering (3)

- Organized Crime (1)

- Racketeering (1)

- Reckless Driving (3)

- RICO (3)

- Sealing and Expunging (2)

- Sex Offense (1)

- Shoplifting (1)

- Suspended Driver's License (1)

- Traffic (4)

- Trending Topics (1)

- White-collar Offenses (1)