Income Tax Fraud Penalties You Should Know

By : saulcrim | Category : Criminal Defense | Comments Off on Income Tax Fraud Penalties You Should Know

1st Jan 2026

The IRS takes tax violations seriously, and the penalties can be severe. Income tax fraud penalties range from substantial fines to criminal imprisonment, depending on the severity of your case.

At Law Offices of Scott B. Saul, we help clients understand the difference between honest mistakes and intentional fraud. This guide breaks down the penalties you face and how to protect yourself.

The Line Between Negligence and Intentional Fraud

The IRS distinguishes between two very different violations: negligence and fraud. Negligence means you made honest mistakes on your return-missing deductions, miscalculating income, or filing late without intent to deceive. Fraud means you deliberately concealed income, filed false documents, or knowingly failed to pay taxes. This distinction matters enormously because the penalties differ drastically. According to U.S. Sentencing Commission data from fiscal year 2024, 360 tax-fraud cases faced prosecution, representing an 11 percent increase since 2020. Among those sentenced, 86.8 percent had little or no prior criminal history, showing that otherwise law-abiding people can face severe consequences for intentional violations. The IRS defines tax fraud as willful deception or concealment to evade taxes, such as filing false returns or deliberately failing to file.

Common red flags the IRS calls badges of fraud include underreporting income, using a false Social Security number, falsifying documents, or deliberately refusing to pay taxes you knew you owed.

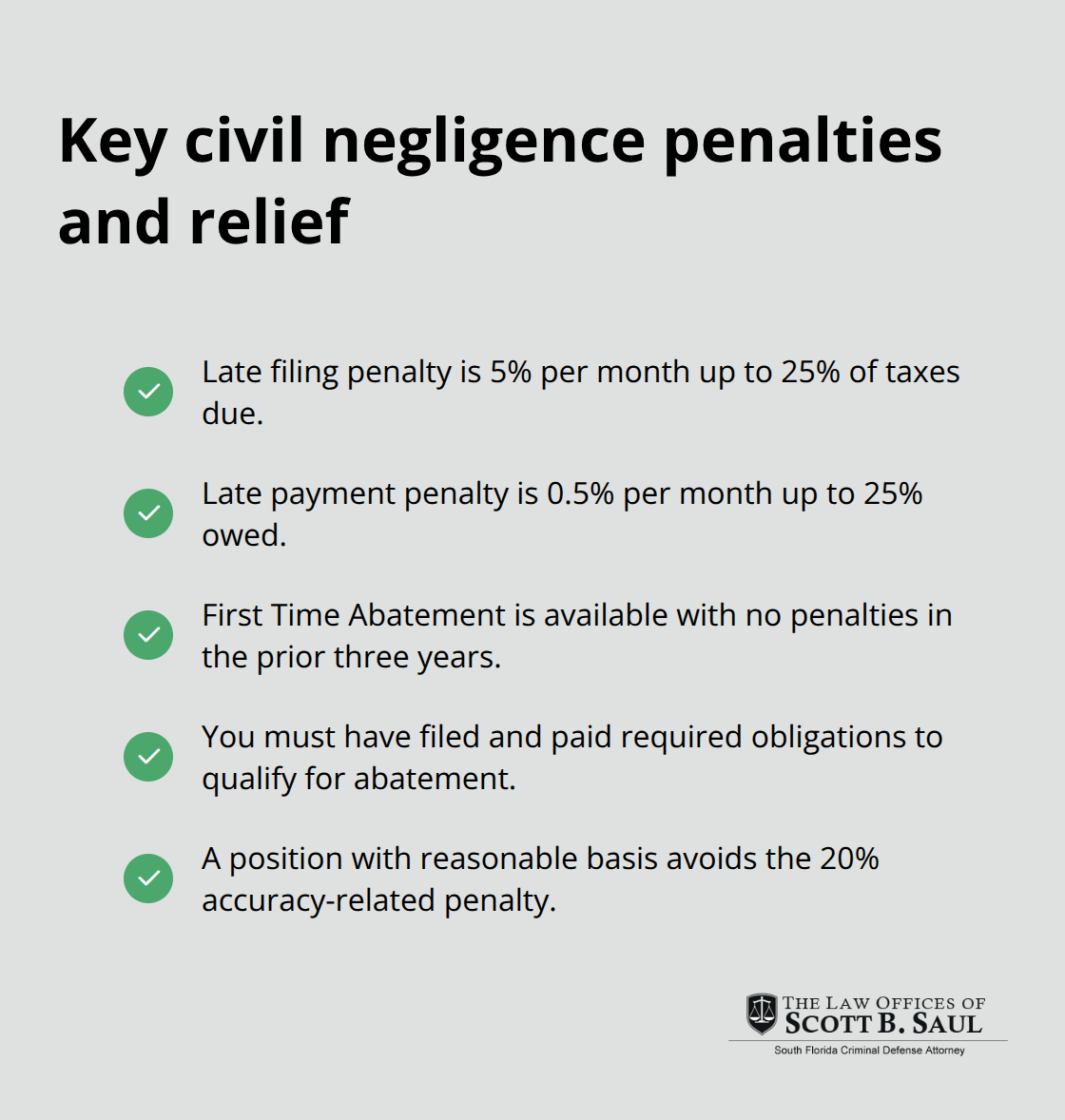

What Negligence Actually Costs You

Civil penalties for negligence are structured and predictable. The accuracy-related penalty under Section 6662 is 20 percent of the understatement amount, applying when you show negligence or disregard for tax rules. Delinquency penalties for late filing start at 5 percent per month up to 25 percent of taxes due, while late payment penalties run 0.5 percent per month up to 25 percent owed. You can reduce these penalties through First Time Abatement if you have no prior penalties in the last three years and have filed and paid tax obligations. A position with reasonable basis avoids the 20 percent accuracy-related penalty entirely.

If you disclose a questionable position on your return using Form 8275 or Form 8275-R, and that position has reasonable basis, the penalty may not apply. This means transparency and documentation actually protect you from the harshest civil penalties.

Criminal Fraud Carries Prison Time

Criminal penalties are where tax violations become serious federal crimes. Tax evasion itself carries up to five years in prison and fines up to $100,000 for individuals, or $500,000 for corporations. Willful failures to file, pay, or keep sufficient records carry up to one year in prison and fines up to $25,000 for individuals. The median loss in FY2024 tax-fraud cases was $491,302, though 20.5 percent involved losses exceeding $1.5 million.

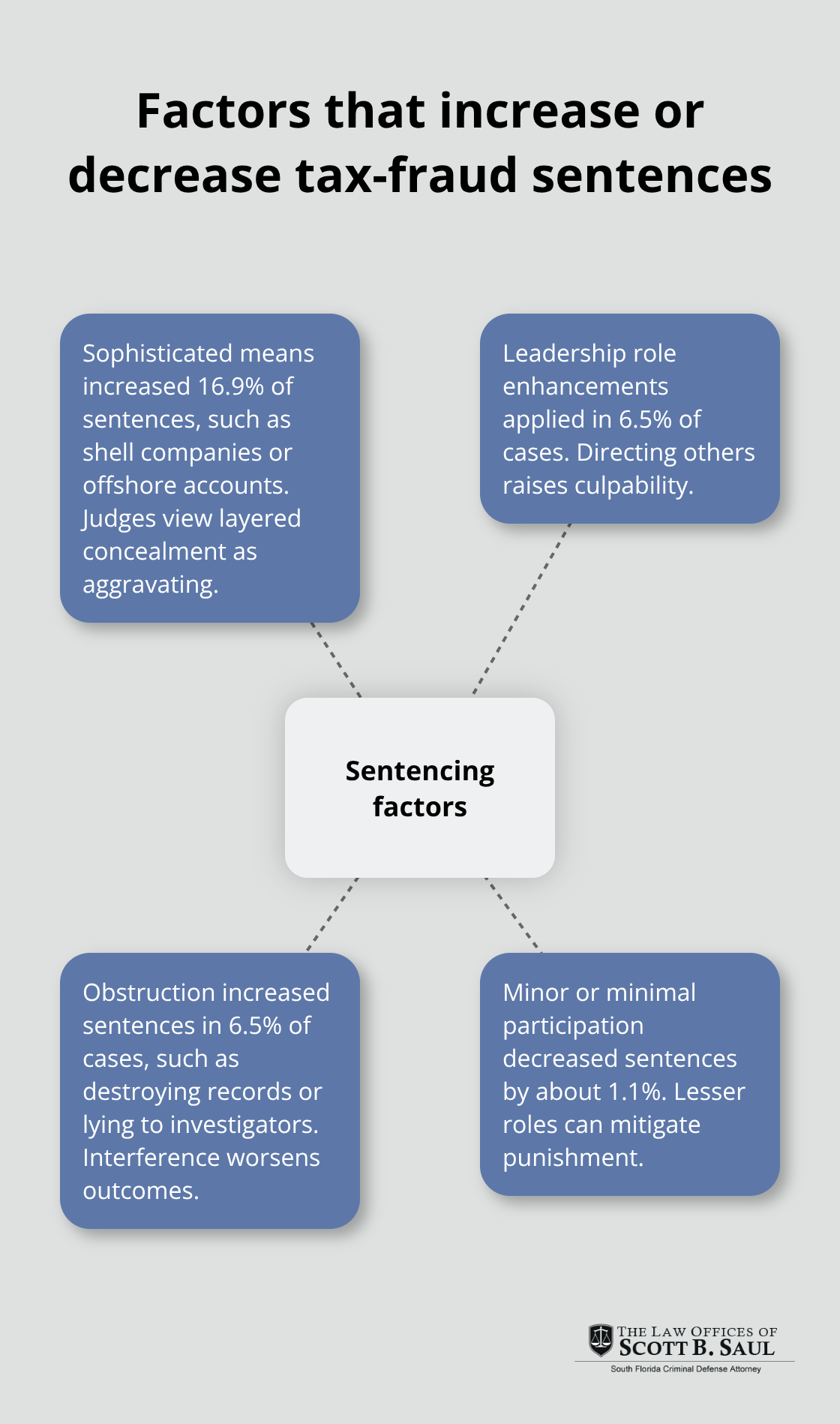

According to U.S. Sentencing Commission data, the average sentence imposed was 15 months, with 66 percent of defendants receiving prison time. Sentences increased substantially when the IRS proved sophisticated means were used (occurring in 16.9 percent of cases) or when defendants held leadership roles (6.5 percent of cases). The burden of proof for criminal fraud is beyond a reasonable doubt, the highest standard in law, meaning prosecutors must present overwhelming evidence of intent to deceive.

How the IRS Proves Intent

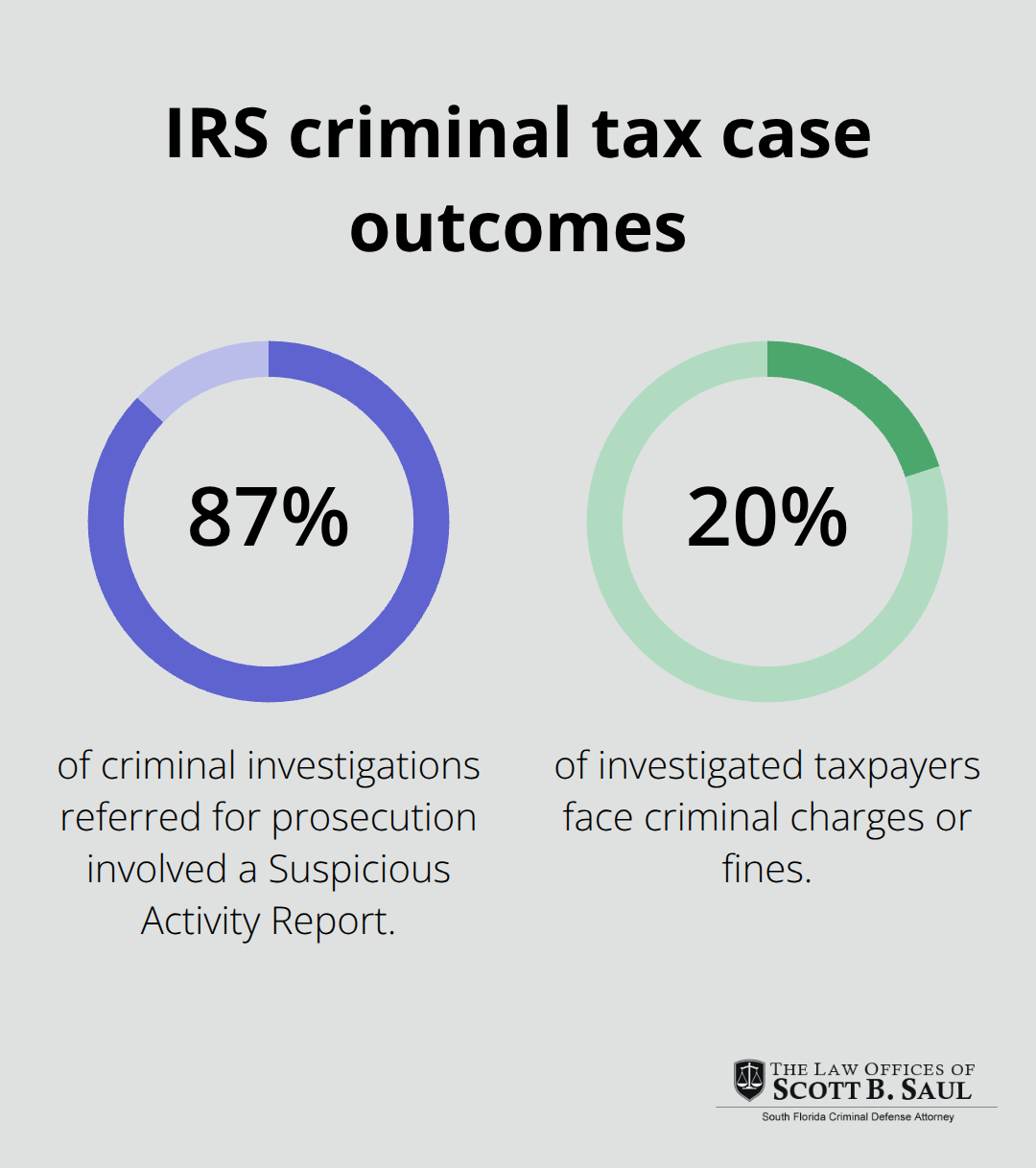

The IRS determines fraud through patterns and documentation. It examines whether you consistently underreported income across multiple years, maintained hidden bank accounts, created false invoices, or paid employees cash under the table. The agency relies heavily on Suspicious Activity Reports from banks under the Bank Secrecy Act to identify money laundering and offshore evasion patterns. From 2022 to 2024, IRS Criminal Investigation used BSA data to discover $21.1 billion in tax fraud, seize $8.2 billion, and recover $1.4 billion in restitution.

About 87 percent of criminal investigations referred for prosecution involved a Suspicious Activity Report, with a 97.3 percent conviction rate. Civil fraud requires clear and convincing evidence, a higher standard than typical tax audits but lower than criminal beyond-a-doubt standards. The IRS investigates fewer than 2 percent of taxpayers overall, but of those investigated, about 20 percent face criminal charges or fines, and fewer than 2,500 Americans are convicted of tax crimes annually.

An unofficial threshold exists around $70,000 of unpaid taxes before criminal prosecution becomes more likely in multi-year cases, though this is not a hard rule and depends on the sophistication and intent involved.

Understanding these distinctions sets the stage for recognizing which penalties apply to your situation and what steps you can take to minimize exposure.

What You’ll Actually Pay in Penalties

The gap between civil and criminal penalties is enormous, and understanding where your case falls determines your financial exposure. Civil fraud penalties under Section 6663 equal 75 percent of the portion of your tax underpayment attributable to fraud. This applies on top of the taxes you owe plus interest, making it substantially harsher than negligence penalties but still far less severe than criminal prosecution. The IRS must prove fraud by clear and convincing evidence in civil cases, meaning they need strong documentation of intentional deception.

Criminal penalties include up to five years in federal prison for tax evasion and fines for individuals. According to U.S. Sentencing Commission data from fiscal year 2024, sentences averaged 15 months, with 66 percent of defendants receiving prison time. The median loss in these cases was $491,302, though some involved losses exceeding $1.5 million. What matters most is that 45.2 percent of sentences fell below the guideline range, averaging a 79.9 percent reduction, showing that judges frequently impose lighter sentences when circumstances warrant leniency.

Interest Compounds Daily and Never Stops

Interest on unpaid taxes compounds daily and cannot be forgiven, unlike some penalties. The IRS charges interest at the federal rate plus 3 percent, currently around 9 percent annually, and this applies to both the original tax liability and any penalties assessed. For someone with $100,000 in unpaid taxes, interest alone could add thousands within the first year.

The statute of limitations for assessing federal income tax is generally three years from the filing date, but extends to six years if you underreported income by more than 25 percent, and becomes indefinite if fraud is proven. This means a fraudulent return filed in 2020 could still face prosecution and penalties in 2026 or beyond. If you suspect you owe back taxes, file amended returns immediately using Form 1040-X rather than waiting for the IRS to discover the discrepancy. Early disclosure demonstrates good faith and may support arguments for penalty abatement or reduced sentencing if criminal charges arise.

Sophistication and Leadership Roles Trigger Harsher Sentences

The U.S. Sentencing Commission found that 16.9 percent of tax-fraud sentences increased due to sophisticated means, such as using shell companies, offshore accounts, or falsified documents. Another 6.5 percent involved defendants in leadership or supervisory roles, meaning those who directed others to commit fraud faced steeper penalties. Obstructing justice-such as destroying records or lying to investigators-triggered sentence increases in 6.5 percent of cases. Conversely, minor or minimal participation decreased sentences by about 1.1 percent.

This data reveals that judges view intentional complexity and orchestrated schemes as far more serious than isolated errors or passive involvement. If you face tax fraud allegations, the sophistication of your alleged conduct directly impacts potential prison time and fines. The next section examines how the IRS identifies these sophisticated schemes and what specific conduct triggers the most aggressive enforcement actions.

How to Protect Yourself From Tax Fraud Charges

The IRS does not care about your intentions when it audits you; it cares about patterns in your return and what your documents prove. The single most effective way to avoid fraud allegations is to maintain contemporaneous records that support every number on your tax return. The IRS Taxpayer Advocate Service specifically warns against red flags like claiming personal expenses as business deductions, inflating charitable contributions without receipts, or reporting inconsistent income across years.

Document Everything With Precision

If you claim a home office deduction, document square footage and business use percentage. If you report business meals, keep dated receipts showing the attendees and business purpose. For tip income, maintain a daily tip diary as the IRS requires. When the IRS reviews your return and finds supporting documentation immediately available, it signals compliance and reduces the likelihood of escalation to fraud investigation. The difference between negligence and fraud often hinges on whether you can produce records proving you attempted accuracy versus deliberately concealing information.

One critical practice is to disclose questionable tax positions upfront using Form 8275 or Form 8275-R. According to IRS guidance, a position with reasonable basis and proper disclosure may avoid the 20 percent accuracy-related penalty entirely. This transparency tells the IRS you consulted tax law and made a good-faith interpretation, not that you were hiding something.

Address Employment Tax Obligations Directly

Employment tax fraud represents one of the most aggressively prosecuted categories, involving underreporting workers, failing to pay payroll taxes, or paying employees cash under the table. If you operate a business, use a payroll service like ADP or Guidepoint to document all employee compensation and tax withholding automatically. The IRS Criminal Investigation division specifically targets employment tax schemes because they involve deliberate concealment and systematic underreporting.

Select a Tax Professional With Verified Credentials

Choosing the right tax professional matters far more than most people realize. The IRS warns that clients can be held liable for penalties and taxes resulting from a preparer’s fraudulent or incompetent work, so you cannot simply blame your accountant if your return contains false claims. Before hiring a tax preparer, verify their credentials on the IRS website and confirm they hold an Enrolled Agent credential, CPA license, or active tax attorney status.

Never sign a blank return or allow a preparer to tell you the refund will be paid directly to them in cash. Review your completed return line by line before signing and ask your preparer to explain any deduction or income item you do not fully understand. If your preparer suggests inflating deductions, using a false business structure to hide income, or claiming credits you do not qualify for, fire them immediately and consult a qualified tax attorney.

The Supreme Court case Boyle v. United States established that merely relying on a professional does not excuse failure to file or pay; however, if a professional erroneously advised you that no filing requirement existed, that reliance can support reasonable cause for penalty relief. This means you remain responsible for verifying your preparer’s advice, not blindly trusting it.

Report All Income Sources Accurately

Income sources that the IRS can verify through third-party reporting-W-2s, 1099s, interest statements, dividend reports-must match your return exactly. The IRS uses automated systems to flag mismatches instantly. If you receive a 1099-NEC for consulting work, that amount appears on IRS records, and failing to report it signals intentional omission.

Cash income and informal payments carry higher fraud risk because they leave no paper trail; however, the IRS increasingly uses bank deposit analysis and Suspicious Activity Reports to identify unreported cash. If you deposited $50,000 in cash but reported $30,000 in business income, investigators will ask detailed questions about the source of those deposits. The safest approach is to report all income regardless of form and to maintain bank statements showing deposits and their sources.

Final Thoughts

Income tax fraud penalties range from civil assessments of 75 percent of underpayments to federal prison sentences averaging 15 months, with some cases involving losses exceeding $1.5 million. The distinction between negligence and intentional fraud determines whether you face manageable civil penalties or criminal prosecution. Your best defense is prevention: maintain detailed records supporting every deduction and income source, report all income including cash payments, use Form 8275 to disclose questionable positions, and work with a qualified tax professional whose credentials you have verified.

If you operate a business, use payroll services to document employee compensation automatically rather than handling cash payments informally. These practices cost far less than defending against fraud allegations or paying the substantial penalties that result from conviction. The IRS does not need to prove you intended to break the law in every case; it only needs to demonstrate a pattern of deliberate concealment or systematic underreporting.

If you face tax fraud allegations, audit notices, or criminal investigation, do not delay in seeking legal representation. The difference between conviction and acquittal often depends on how quickly you respond and what evidence you preserve. Contact Law Offices of Scott B. Saul today for a comprehensive consultation about your situation and your options.

Archives

- February 2026 (5)

- January 2026 (9)

- December 2025 (9)

- November 2025 (8)

- October 2025 (8)

- September 2025 (9)

- August 2025 (8)

- July 2025 (8)

- June 2025 (9)

- May 2025 (9)

- April 2025 (8)

- March 2025 (9)

- February 2025 (8)

- January 2025 (9)

- December 2024 (10)

- November 2024 (5)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (2)

- November 2023 (2)

- October 2023 (2)

- September 2023 (2)

- August 2023 (1)

- July 2023 (2)

- June 2023 (2)

- May 2023 (2)

- April 2023 (2)

- March 2023 (2)

- February 2023 (2)

- January 2023 (2)

- December 2022 (2)

- November 2022 (2)

- October 2022 (2)

- September 2022 (2)

- August 2022 (2)

- July 2022 (2)

- June 2022 (2)

- May 2022 (2)

- April 2022 (2)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- December 2021 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (2)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- April 2021 (2)

- September 2020 (5)

- July 2020 (4)

- June 2020 (4)

- May 2020 (4)

- April 2020 (5)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (1)

- November 2019 (4)

- October 2019 (4)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (4)

- April 2019 (4)

- March 2019 (4)

- February 2019 (4)

- January 2019 (4)

- December 2018 (4)

- November 2018 (5)

- October 2018 (5)

- September 2018 (4)

- August 2018 (4)

- July 2018 (7)

- June 2018 (4)

- May 2018 (4)

- April 2018 (8)

- March 2018 (4)

- February 2018 (4)

- January 2018 (4)

- November 2017 (4)

- October 2017 (4)

- September 2017 (4)

- August 2017 (7)

- July 2017 (6)

- June 2017 (4)

- May 2017 (4)

- April 2017 (4)

- March 2017 (4)

- February 2017 (7)

- January 2017 (4)

- December 2016 (7)

- November 2016 (4)

- October 2016 (4)

- September 2016 (10)

- August 2016 (4)

- July 2016 (4)

- June 2016 (4)

- May 2016 (4)

- April 2016 (4)

- March 2016 (4)

- February 2016 (7)

- January 2016 (4)

- December 2015 (5)

- November 2015 (4)

- October 2015 (7)

- September 2015 (4)

- August 2015 (4)

- July 2015 (13)

- June 2015 (9)

- May 2015 (8)

- April 2015 (6)

- March 2015 (4)

- February 2015 (4)

- January 2015 (4)

- December 2014 (4)

- November 2014 (4)

- October 2014 (4)

- September 2014 (3)

Categories

- Adjudication (1)

- Bankruptcy (1)

- Burglary Crimes (3)

- calendar call (1)

- Car Accident (1)

- Criminal Defense (395)

- Cyber Crimes (7)

- DNA (1)

- Domestic Violence (9)

- Drug Crimes (5)

- DUI (12)

- Embezzlement (1)

- Environmental Crimes (4)

- Expungement Law (2)

- Federal Sentencing Law (3)

- Firearm (3)

- Forgery (4)

- General (82)

- Healthcare (3)

- Immigration (1)

- Indentity Theft (1)

- Insurance (5)

- judicial sounding (2)

- Juvenile Crimes (4)

- Manslaughter (4)

- Money Laundering (3)

- Organized Crime (1)

- Racketeering (1)

- Reckless Driving (3)

- RICO (3)

- Sealing and Expunging (2)

- Sex Offense (1)

- Shoplifting (1)

- Suspended Driver's License (1)

- Traffic (4)

- Trending Topics (1)

- White-collar Offenses (1)