Is Tax Fraud a Felony or Misdemeanor?

By : saulcrim | Category : Criminal Defense | Comments Off on Is Tax Fraud a Felony or Misdemeanor?

9th Feb 2026

The IRS takes tax violations seriously, and the consequences depend heavily on whether your case is classified as a felony or misdemeanor. Understanding this distinction matters because it affects everything from potential prison time to fines and professional consequences.

At Law Offices of Scott B. Saul, we help clients navigate these complex charges. The answer to whether tax fraud is a felony or misdemeanor isn’t simple-it depends on specific factors we’ll break down here.

What Actually Counts as Tax Fraud

Tax fraud under federal law means willfully and deliberately submitting false information on a tax return or concealing income to reduce what you owe. The IRS defines it as the willful and material submission of false statements or documents in connection with a tax return or application. This distinction matters because honest mistakes don’t qualify as fraud-the government must prove you acted with intent.

According to IRS guidance, the federal elements of tax evasion require three things: willfulness, an affirmative act to evade taxes, and a tax deficiency showing actual taxes were owed but not paid. Without all three, prosecutors may pursue other charges instead, such as willful failure to file under 26 U.S.C. § 7203, which doesn’t require proving evasion but only willful noncompliance.

Tax Avoidance vs. Tax Fraud

The difference between tax avoidance and tax fraud is critical. Tax avoidance uses legal strategies to minimize liability, while fraud involves illegal means to evade paying taxes. Many people confuse the two, but the IRS investigates actual fraud cases and refers them to federal prosecutors in federal court.

Federal Law Creates the Harshest Penalties

Under 26 U.S.C. § 7201, federal tax evasion is a felony carrying up to five years in prison and fines up to $250,000 for individuals or $500,000 for corporations. Federal charges also include willful failure to pay taxes under § 7203, a misdemeanor with up to one year in jail and $25,000 in fines for individuals.

The government can also charge conspiracy under 18 U.S.C. § 371, filing false returns under § 7206, or obstructing the IRS under § 7212(a) depending on the facts. Prosecutors have flexibility in choosing which offenses to charge. Beyond criminal penalties, the IRS imposes civil fraud penalties equal to 75% of the underpayment attributable to fraud, plus interest and other penalties. Civil and criminal penalties can apply simultaneously for the same conduct.

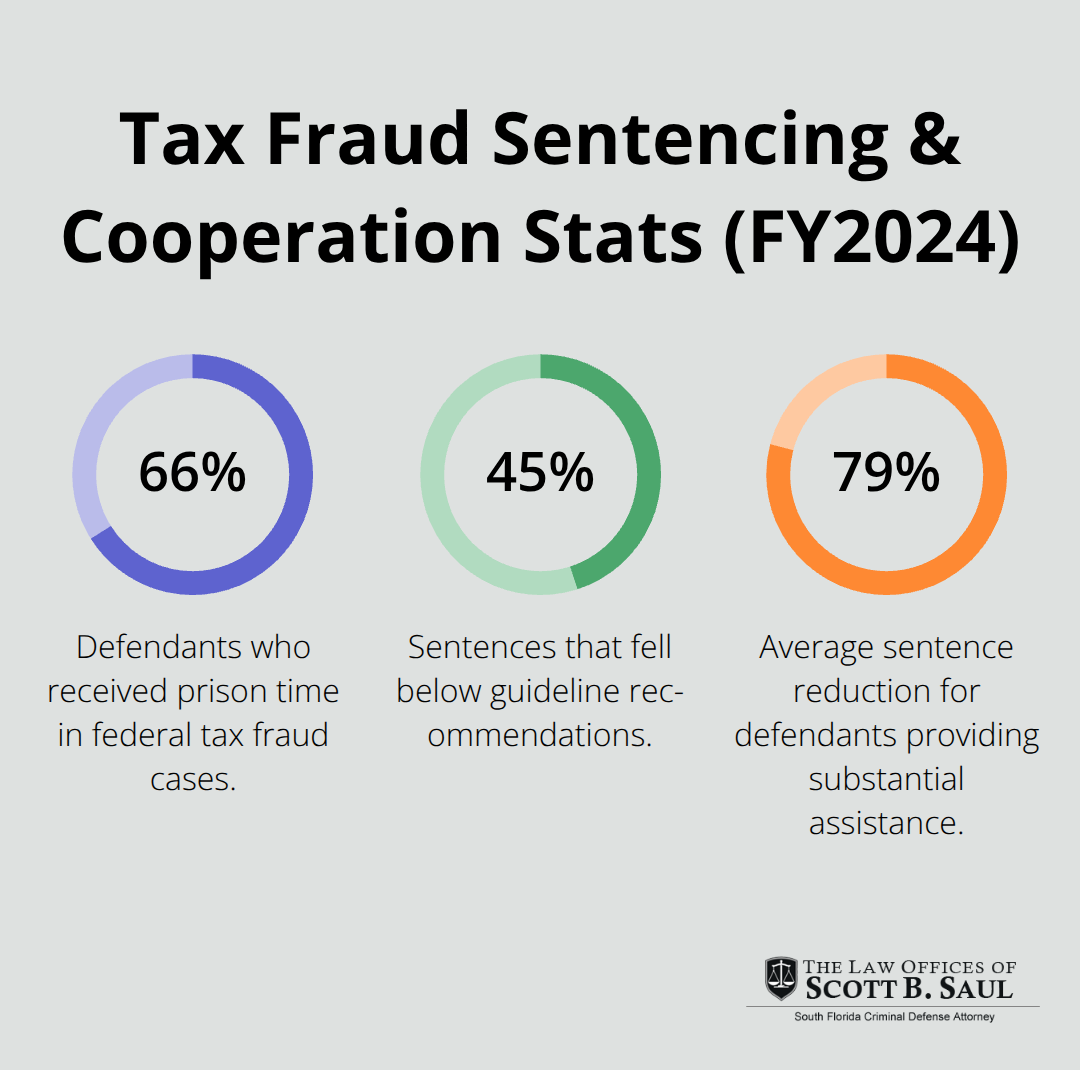

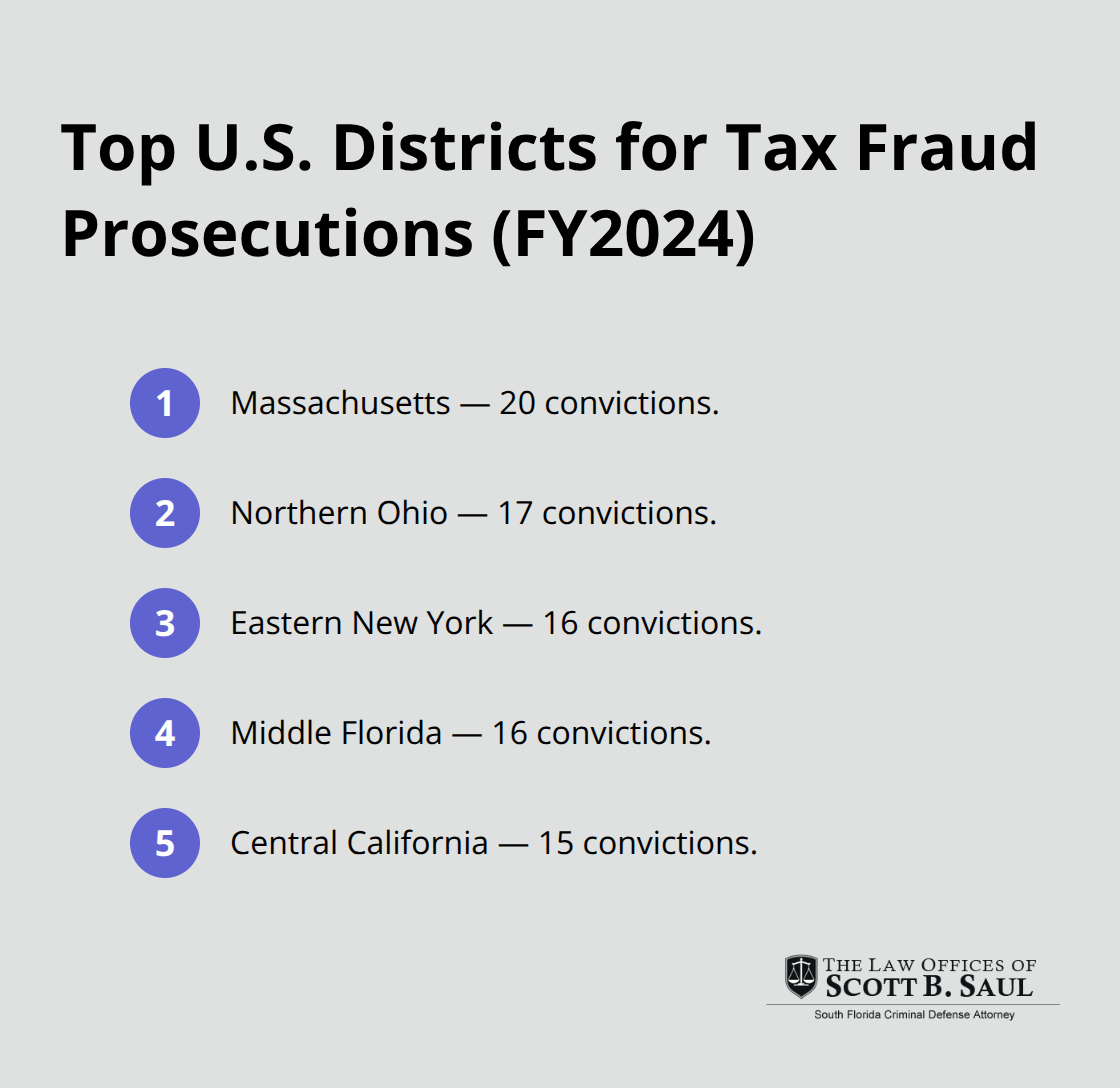

Real data from the U.S. Sentencing Commission shows that in FY2024, 360 tax fraud convictions resulted in convictions, with a median loss of $491,302. The average sentence was 15 months, with 66% of defendants receiving prison time. The top five districts for prosecutions were Massachusetts, Northern Ohio, Eastern New York, Middle Florida, and Central California.

State Laws Vary Dramatically

State tax evasion charges depend entirely on where you live and the amount involved. In Georgia, evading $3,000 or less in state taxes is generally a misdemeanor, but anything above that becomes a felony. Illinois imposes harsher sentences-up to seven years in prison and fines up to 50% of the evaded taxes.

Texas reaches even further with up to ten years in prison and $10,000 in fines. New York and California typically cap state charges at one year in county jail with fines up to $1,000, though additional penalties apply. The variation means conduct that triggers a misdemeanor in one state could be a felony in another. Prosecutors often pursue both federal and state charges simultaneously when the conduct violates multiple jurisdictions.

The specific factors that determine whether you face felony or misdemeanor charges-and the severity of those charges-depend on more than just geography and dollar amounts.

What Pushes a Tax Case Into Felony Territory

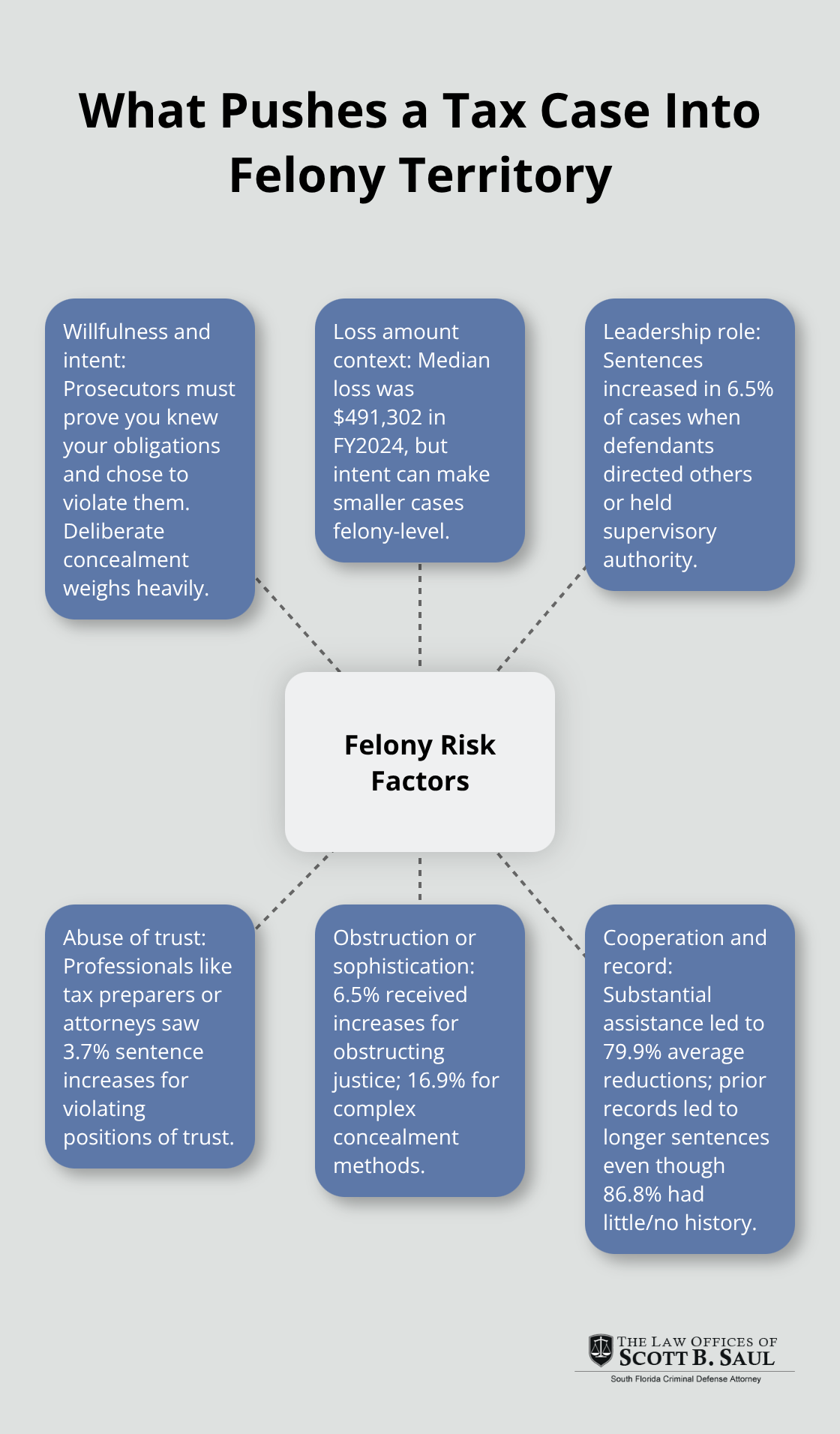

The dollar amount matters far more than people realize, but it’s not the only factor that determines whether prosecutors pursue felony charges. Under federal law, no minimum threshold automatically triggers a felony versus a misdemeanor. Instead, prosecutors evaluate the total tax deficiency alongside other aggravating factors. According to U.S. Sentencing Commission data from FY2024, the median loss in tax fraud cases was $491,302, yet sentences varied dramatically. Some defendants with losses under $100,000 received prison time, while others with substantially larger deficiencies negotiated lighter penalties. This inconsistency reflects how willfulness and intent dominate charging decisions.

The IRS Criminal Investigation division prioritizes cases showing deliberate concealment over simple underpayment errors. A person who underreports $50,000 in income through an offshore account faces different prosecution pressure than someone who made honest mistakes on their return. Willfulness is the prosecution’s burden to prove-they must demonstrate you knew your legal obligations and chose to violate them anyway.

How Intent and Knowledge Shape Charges

The Supreme Court’s decision in Cheek v. United States established that genuine ignorance of tax law can be a defense, though the court clarified that clearly unreasonable beliefs won’t hold up. This means if you legitimately didn’t understand filing requirements for foreign income, that distinction matters meaningfully compared to deliberately hiding accounts. Prosecutors must show you acted with knowledge and intent, not merely that you failed to pay taxes.

Your criminal history shapes charging decisions significantly. Defendants with prior convictions face harsher treatment and less negotiating room. The U.S. Sentencing Commission reported that in FY2024, 86.8% of tax fraud defendants had little or no prior criminal history, yet those with records received longer sentences. Prosecutors view repeat offenders as more culpable and less likely to accept rehabilitation. If you’ve faced previous tax violations or any criminal charges, expect federal prosecutors to push for felony classification.

Professional Status and Leadership Roles

Your position matters considerably in tax fraud cases. If you directed others to participate in the scheme or held supervisory authority, prosecutors treat you more harshly. The Sentencing Commission documented that 6.5% of sentences increased because defendants held leadership roles. A business owner who instructed employees to work off-the-books faces different pressure than a lower-level employee following orders.

Professionals with special credentials face elevated scrutiny. Tax preparers, accountants, and attorneys charged with fraud receive harsher sentences because they violated positions of trust. The Sentencing Commission noted that 3.7% of sentences increased for abusing professional positions. This is critical: if you hold a license or professional credential, tax fraud charges threaten not just prison time but permanent career destruction through license revocation or suspension.

Concealment Methods and Obstruction

How aggressively you concealed the fraud matters enormously. If you destroyed records, lied to investigators, or actively obstructed the IRS, prosecutors add obstruction charges under 26 U.S.C. § 7212(a). The Sentencing Commission found that 6.5% of tax fraud defendants received sentence increases for obstructing justice. Whether you used sophisticated methods to conceal the fraud also influences charging severity. The Sentencing Commission found that 16.9% of defendants received sentence increases for using complex schemes to hide their conduct. Employment tax fraud schemes involving multiple false filings or elaborate offshore structures trigger felony treatment more readily than single-year reporting errors.

Cooperating with authorities early generates substantial sentence reductions. Defendants who provided substantial assistance received average sentence reductions of 79.9%, according to the Sentencing Commission. This single factor can transform a multi-year prison exposure into months of incarceration. The timing and manner of your response to investigation determine whether prosecutors view you as someone worth negotiating with or someone to pursue aggressively.

What Prison Time and Fines Actually Look Like

Federal felony convictions under 26 U.S.C. § 7201 carry up to five years in prison and fines reaching $250,000 for individuals or $500,000 for corporations. Misdemeanor convictions under § 7203 cap out at one year in jail with $25,000 in individual fines. Real sentencing data from the U.S. Sentencing Commission shows the average federal tax fraud defendant received 15 months in prison during FY2024, though 66% of defendants faced actual incarceration.

How Sentencing Data Reveals Real Outcomes

The median loss in these cases was $491,302, demonstrating prosecutors target substantial underpayments. What matters most: the Sentencing Commission found that 45.2% of sentences fell below guideline recommendations, meaning judges frequently imposed lighter penalties than prosecutors requested. This happens when defendants cooperate early or lack prior records. Conversely, 54.8% of sentences involved variances, with 54.5% going downward and 0.3% upward, indicating individual circumstances reshape outcomes dramatically.

Geographic Prosecution Patterns

The location of your prosecution matters significantly. Massachusetts led federal prosecutions with 20 tax fraud convictions in FY2024, followed by Northern Ohio with 17, Eastern New York with 16, and Middle Florida with 16. Central California rounded out the top five with 15 convictions. These districts show aggressive prosecution patterns, and judges in these regions typically impose sentences closer to guideline ranges. If your case lands in Massachusetts or Ohio, expect harsher treatment than in other jurisdictions.

Civil Penalties That Devastate Finances

Beyond imprisonment and fines, civil fraud penalties devastate finances permanently. The IRS imposes civil fraud penalties equal to 75% of the underpayment attributable to fraud, plus interest accruing continuously. A $500,000 underpayment generates a $375,000 civil penalty before interest compounds. These penalties apply simultaneously with criminal sentences, creating dual financial exposure that most defendants underestimate.

Professional License Revocation and Career Destruction

Professional license revocation represents the hidden catastrophe most defendants underestimate. Tax preparers, accountants, attorneys, and real estate professionals lose their credentials permanently following conviction. State licensing boards treat tax fraud convictions as disqualifying offenses with no path to reinstatement. The Sentencing Commission documented that 3.7% of sentences increased for defendants who abused professional positions, but the actual professional destruction extends far beyond prison time. Employment records become permanently tainted, making future work in financial, legal, or accounting fields impossible. Background checks reveal convictions indefinitely, affecting housing applications, business partnerships, and loan eligibility.

The Cooperation Advantage

Defendants with substantial assistance agreements received average sentence reductions of 79.9%, proving early cooperation generates massive benefits. If you face tax fraud charges, contacting experienced criminal defense counsel immediately determines whether you secure these cooperation benefits or face maximum exposure.

Final Thoughts

Whether tax fraud qualifies as a felony or misdemeanor hinges on the specific conduct, jurisdiction, and prosecution strategy. Federal law treats willful evasion under 26 U.S.C. § 7201 as a felony with up to five years in prison, while misdemeanor violations under § 7203 cap at one year in jail. The dollar amount matters less than willfulness, intent, professional status, and your response to investigation-a $50,000 underpayment with deliberate concealment generates different prosecution pressure than a $500,000 error made without intent to defraud.

Contacting experienced criminal defense counsel immediately determines whether you secure cooperation benefits or face maximum exposure. Defendants who reached out early obtained average sentence reductions of 79.9% through cooperation agreements, while those who delayed faced guideline sentences with minimal negotiating room. Your attorney shapes how prosecutors view you-either as someone worth negotiating with or someone to pursue aggressively.

We at Law Offices of Scott B. Saul recognize the stakes involved in tax fraud cases. Led by Scott B. Saul, a former federal and state prosecutor with over 30 years of experience and a track record of successfully trying over 300 jury cases, our firm provides aggressive criminal defense across South Florida. Contact our Miami-Dade and Broward County offices today to protect your rights and your future.

Archives

- February 2026 (3)

- January 2026 (9)

- December 2025 (9)

- November 2025 (8)

- October 2025 (8)

- September 2025 (9)

- August 2025 (8)

- July 2025 (8)

- June 2025 (9)

- May 2025 (9)

- April 2025 (8)

- March 2025 (9)

- February 2025 (8)

- January 2025 (9)

- December 2024 (10)

- November 2024 (5)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (2)

- November 2023 (2)

- October 2023 (2)

- September 2023 (2)

- August 2023 (1)

- July 2023 (2)

- June 2023 (2)

- May 2023 (2)

- April 2023 (2)

- March 2023 (2)

- February 2023 (2)

- January 2023 (2)

- December 2022 (2)

- November 2022 (2)

- October 2022 (2)

- September 2022 (2)

- August 2022 (2)

- July 2022 (2)

- June 2022 (2)

- May 2022 (2)

- April 2022 (2)

- March 2022 (2)

- February 2022 (2)

- January 2022 (2)

- December 2021 (2)

- November 2021 (2)

- October 2021 (2)

- September 2021 (2)

- August 2021 (2)

- July 2021 (2)

- June 2021 (2)

- May 2021 (2)

- April 2021 (2)

- September 2020 (5)

- July 2020 (4)

- June 2020 (4)

- May 2020 (4)

- April 2020 (5)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (1)

- November 2019 (4)

- October 2019 (4)

- September 2019 (4)

- August 2019 (4)

- July 2019 (5)

- June 2019 (4)

- May 2019 (4)

- April 2019 (4)

- March 2019 (4)

- February 2019 (4)

- January 2019 (4)

- December 2018 (4)

- November 2018 (5)

- October 2018 (5)

- September 2018 (4)

- August 2018 (4)

- July 2018 (7)

- June 2018 (4)

- May 2018 (4)

- April 2018 (8)

- March 2018 (4)

- February 2018 (4)

- January 2018 (4)

- November 2017 (4)

- October 2017 (4)

- September 2017 (4)

- August 2017 (7)

- July 2017 (6)

- June 2017 (4)

- May 2017 (4)

- April 2017 (4)

- March 2017 (4)

- February 2017 (7)

- January 2017 (4)

- December 2016 (7)

- November 2016 (4)

- October 2016 (4)

- September 2016 (10)

- August 2016 (4)

- July 2016 (4)

- June 2016 (4)

- May 2016 (4)

- April 2016 (4)

- March 2016 (4)

- February 2016 (7)

- January 2016 (4)

- December 2015 (5)

- November 2015 (4)

- October 2015 (7)

- September 2015 (4)

- August 2015 (4)

- July 2015 (13)

- June 2015 (9)

- May 2015 (8)

- April 2015 (6)

- March 2015 (4)

- February 2015 (4)

- January 2015 (4)

- December 2014 (4)

- November 2014 (4)

- October 2014 (4)

- September 2014 (3)

Categories

- Adjudication (1)

- Bankruptcy (1)

- Burglary Crimes (3)

- calendar call (1)

- Car Accident (1)

- Criminal Defense (393)

- Cyber Crimes (7)

- DNA (1)

- Domestic Violence (9)

- Drug Crimes (5)

- DUI (12)

- Embezzlement (1)

- Environmental Crimes (4)

- Expungement Law (2)

- Federal Sentencing Law (3)

- Firearm (3)

- Forgery (4)

- General (82)

- Healthcare (3)

- Immigration (1)

- Indentity Theft (1)

- Insurance (5)

- judicial sounding (2)

- Juvenile Crimes (4)

- Manslaughter (4)

- Money Laundering (3)

- Organized Crime (1)

- Racketeering (1)

- Reckless Driving (3)

- RICO (3)

- Sealing and Expunging (2)

- Sex Offense (1)

- Shoplifting (1)

- Suspended Driver's License (1)

- Traffic (4)

- Trending Topics (1)

- White-collar Offenses (1)